|  |  |  Americas & Beyond Americas & Beyond

Nigeria Files Charges Against Cheney in Halliburton Bribery Scheme

Jason Leopold - t r u t h o u t Jason Leopold - t r u t h o u t

go to original

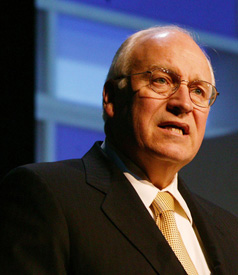

| | Dick Cheney (Jean-Bernard Sieber/World Economic Forum) |  |

Dick Cheney is officially a wanted man.

The former vice president was indicted Tuesday by Nigeria's Economic and Financial Crime Commission along with eight other current and former company executives in a bribery and conspiracy scheme related to the construction of a liquefied natural gas facility in the country that took place while Cheney was chief executive of Halliburton.

Halliburton and its one-time subsidiary, Kellogg, Brown & Root (KBR), were also charged. KBR, which also has handled lucrative US government support contracts for US troops in Iraq and elsewhere, was spun off from Halliburton in 2007 into a separate company.

"It includes Dick Cheney," said Nigerian prosecutor Godwin Obla, about the 16-count charge filed in Abuja, Nigeria's capital. "There are conspiracy charges and giving gratification to public officers. There is also a charge for obstruction of justice...It is important to stress that the filing of this charge today is just one out of many steps that would be taken by the prosecution."

"The illicit proceeds of that enterprise would be located. Properties acquired in consequence of this would be traced and forfeited and organizations associated with the criminal enterprise may be liable to forfeiture to the state of Nigeria," Obla added.

Although Nigerian government officials said they would seek Cheney's extradition to respond to the charges, the US government likely won't entertain such a request. Each charge in the indictment carries a three-year prison sentence.

Cheney's lawyer, Terrence O'Donnell, said an investigation conducted by federal prosecutors in the United States "found no suggestion of any impropriety by Dick Cheney in his role of CEO of Halliburton."

"Any suggestion of misconduct on his part, made now, years later, is entirely baseless," O'Donnell said.

Tara Mullee, a Halliburton spokeswoman said, “It is still our position that Halliburton was not involved in the project to which this bribery investigation relates and there is no legal basis for charges."

The charges revolve around $180 million in bribes allegedly paid to Nigerian government officials between 1994 and 2004 to win a $6 billion construction contract for the Bonny Island natural gas liquefaction plant. The bribes allegedly went to the notoriously corrupt Nigerian dictator Sani Abacha and some of his subordinates.

The cash allegedly was laundered through UK lawyer Jeffrey Tesler, who served as a consultant to KBR after it was formed in a 1998 merger that Cheney engineered between Halliburton and Dresser Industries. Tesler was hired in 1995 as an agent of a four-company joint venture that was awarded four engineering, procurement and construction (EPC) contracts by Nigeria LNG Ltd., (NLNG). Tesler was indicted last year and he is fighting extradition to the US.

In a quarterly filing to the Securities and Exchange Commission in October 2007, Halliburton said it was subpoenaed by the DOJ and the SEC over the use - by the KBR-led consortium known as TSKJ - "of an immigration services provider, apparently managed by a Nigerian immigration official, to which approximately $1.8 million in payments in excess of costs of visas were allegedly made between approximately 1997 and the termination of the provider in December 2004..."

Nigerian prosecutors also filed charges Tuesday against the TSKJ consortium.

The charges against Cheney and others come as Nigeria prepares for a presidential election in April. Anti-corruption officials last week raided Halliburton's Lagos offices and arrested 23 people, including 10 who worked for the company, and seized documents. Those arrested have since been released.

On Monday, the Justice Department (DOJ) announced that Tesler's associate, Wojciech J. Chodan, the former vice president to KBR's UK subsidiary, pleaded guilty to violating the Foreign Corrupt Practices Act (FCPA) for his role in the bribery scandal.

Chodan was extradited to the United States last week from England. He is scheduled to be sentenced in February and faces a maximum five years in federal prison.

French Disclosures

The bribery investigation was launched in 2003 when Georges Krammer, a former executive with the French company Technip (also charged Tuesday), a member of the consortium for the Bonny Island project, informed French magistrate Renaud Van Ruymbeke that the contracts his group obtained came as a result of payments Tesler made to Nigerian officials from a slush fund the lawyer allegedly managed.

In June, the DOJ filed a deferred prosecution agreement and criminal information against Technip. The company, also charged in the bribery scheme in Nigeria Tuesday, agreed to pay a total of $338 million in criminal and civil fines and retain an independent compliance monitor for two years.

For more than a year, the French magistrate poured over evidence to determine whether Cheney may have been responsible under French law for at least one of four bribery payments to the Nigerian officials.

Under French law, "the head of a company can be charged with 'misuse of corporate assets' for bribes paid by any employee - even if the executive didn't know about the improper payments."

During Cheney's tenure, Halliburton did expand operations in Nigeria despite human rights abuses by General Abacha's regime and environmental damage to the Niger Delta caused by international oil companies, Shell and Chevron, both of which signed contracts with Halliburton subsidiaries.

Shell and some of its corporate executives are also the subject of a separate bribery investigation in Nigeria. The company paid $48 million in fines last month to the US government to settle criminal charges that it violated FCPA in connection with that case.

In April 2000, Brown & Root Energy Services, a business unit of Halliburton, was selected by Shell Petroleum Development Co. of Nigeria to work on the development of an offshore oil and gas facility, the first of its kind for Shell.

The deal, valued at $300 million, had been questioned by activists who have tried to hold Shell accountable for the pollution and the human rights abuses that have harmed Nigerian indigenous groups in a part of the Niger Delta known as Ogoniland.

In its four-plus decades of oil exploration in Nigeria, Shell has been responsible for repeated environmental calamities, involving oil spills, noxious gas flares, cleared forests, despoiled farmland and pipeline blowouts.

General Abacha's appreciation for the money that Shell's operations put into his coffers made him an eager ally when the oil industry faced popular protests, which were crushed by the dictator's army and security forces.

In 1995, the year Cheney joined Halliburton, renowned writer and environmental advocate Ken Saro-Wiwa and eight of his colleagues were hanged by the Abacha government for their efforts to prevent Shell from continuing to poison the environment of the Niger Delta.

It is estimated that more than 2,000 people have been murdered for their involvement in protests against Shell's activities in the Delta. Most of those murdered were Ogoni who had rallied behind Saro-Wiwa in the early 1990s.

In 1998, General Abacha died of an apparent heart attack.

Guilty Pleas

Last year, KBR pleaded guilty to violating FCPA and admitted that it paid $180 million in "consulting fees" to Tesler and a Japanese trading company for use in bribing Nigerian government officials. KBR paid a $402 million fine to as part of its plea deal.

Under the terms of the plea agreement, KBR agreed to retain an independent compliance monitor for three years to ensure it is abiding by US laws, limit its use of foreign agents and promised to file regular reports on the compliance program with the DOJ.

But KBR said in a 10-K filing with the SEC last year that "limitations on our use of agents as part of our efforts to comply with applicable laws, including the FCPA, could put us at a competitive disadvantage in pursuing large-scale international projects."

However, the plea deal did not impact KBR’s ability to secure lucrative government contracts.

In fact, according to KBR's SEC filing, the company said it received written notification from the US. Department of the Army “stating that it does not intend to suspend or debar KBR from [Department of Defense] contracting as a result of the guilty plea by KBR LLC.”

Additionally, KBR revealed in the same SEC filing that the company uncovered "information" that shows former executives may have been involved in a bidding scheme with its competitors, but that the DOJ agreed not to pursue the matter in exchange for KBR's guilty plea.

"In connection with the investigation into payments relating to the Bonny Island project in Nigeria, information has been uncovered suggesting that [former KBR CEO Albert "Jack"] Stanley and other former employees may have engaged in coordinated bidding with one or more competitors on certain foreign construction projects, and that such coordination possibly began as early as the mid-1980s," the company's SEC filing said. "In connection with KBR LLC's agreeing to enter into the plea agreement described above, the DOJ has agreed not to pursue any further investigation or penalties relating to the coordinated bidding allegations."

Stanley was a close associate of Cheney. The former vice president promoted him in 1998 to head KBR.

According to the DOJ, at critical junctures before the EPC contracts were awarded, Stanley and others allegedly met with three successive former holders of a top-level office in the executive branch of the Nigerian government to ask the office holder to designate a representative with whom the joint venture should negotiate the bribes.

In September 2008, Stanley pleaded guilty to conspiracy to commit wire and mail fraud and conspiring to violate FCPA. Stanley faces seven years in prison and nearly $11 million in restitution payments. He remains free on bail pending a sentencing hearing scheduled for January.

According to last year's plea deal, Stanley started paying bribes in 1995, the year Cheney was named chief executive of the corporation, and ended when Stanley was fired in 2004.

Stanley, KBR's current CEO William Utt and Halliburton CEO David Lesar, were also named in the indictment filed by Nigerian officials Tuesday.

Aggressive Accounting Practices

Although Cheney's five-year tenure at the helm of Halliburton made him a rich man, controversies surrounding the Houston-based company have dogged him since he became vice president.

During the 2004 presidential campaign, Halliburton agreed to a $7.5 million settlement with the Securities and Exchange Commission (SEC) over suspect accounting practices that took place during Cheney's affiliation with the company.

The SEC said Halliburton changed the way it accounted for construction revenues in 1998 and did not report that change to investors for more than a year, a violation of securities rules.

The accounting sleight of hand by Halliburton caused the company's public statements regarding its income in 1998 and 1999 to be materially misleading, boosting Halliburton's paper profits by $120 million.

"In the absence of any disclosure, the investing public was deprived of a full opportunity to assess Halliburton's reported income more particularly, the precise nature of that income, and its comparability to Halliburton's income in prior periods," the SEC said.

The changes to the company's accounting practices led to a "significant difference in their respective effects on Halliburton's financial presentation: the new practice reduced losses on several large construction projects" and allowed the company to report a higher profit, the SEC said.

The accounting practices, which gave Wall Street the false impression that the oil-field services company was profitable between 1998 and 1999, boosted the value of Halliburton's stock and helped Cheney earn more than $35 million when he sold his shares in 2000.

The New York Times quoted two former Dresser Industries executives in a May 22, 2002, story as saying that after Cheney guided the merger of Dresser with Halliburton in 1998, Halliburton "instituted aggressive accounting practices to obscure its losses."

The accounting change altered the way Halliburton booked revenues from cost overruns on construction projects. Previously, the company waited until a figure was agreed upon with a client. After 1998, however, Halliburton booked revenues that it assumed a customer would pay even though the agreed-upon number might turn out to be lower.

Halliburton spokeswoman Wendy Hall said at the time that Cheney "was aware we accrued revenue on unapproved claims in accordance with generally accepted accounting principles."

The gimmick, signed off on by the now-defunct accounting firm Arthur Andersen, allowed Halliburton to add $89 million in revenues to its books in 1998, helping the company beat its earnings target by 2 cents a share for the year and boosting its stock value.

If the accounting change hadn't been employed, said Wall Street analysts, the company would have missed its earnings target by 11 cents a share, which would surely have depressed the stock price.

During Cheney's tenure, accounting irregularities at the company exceeded $234 million, according to documents obtained by the watchdog group Center for Public Integrity.

Halliburton also faced allegations that it overbilled for work at Fort Ord in California under Cheney's watch, a complaint similar to more recent charges that Halliburton padded its military contract work in Iraq.

Following revelations that Cheney made $35 million from his sales of Halliburton stock before the company's share price fell on the announcement in 2000 that the company was being investigated, The Washington Post, on July 16, 2002, summed up Cheney's tenure at Halliburton this way:

| The developments at Halliburton since Cheney's departure leave two possibilities: Either the vice president did not know of the magnitude of problems at the oilfield services company he ran for five years, or he sold his shares in August 2000 knowing the company was likely headed for a fall. |

As Halliburton's CEO, Cheney was responsible for Halliburton's books. He went out of his way to praise the work done for Halliburton by Arthur Andersen, the accounting firm that unraveled in 2002 after it was found guilty of obstruction of justice for destroying documents for another energy-related client, Enron.

In a 1996 promotional video for Arthur Andersen, Cheney lauded the firm for its business advice:

| One of the things I like that they do for us is that, in effect, I get good advice, if you will, from their people based upon how we're doing business and how we're operating, over and above the, just sort of the normal by-the-books audit arrangement. |

The SEC questioned Cheney during its two-year-long probe of Halliburton's accounting irregularities and concluded that he should not be held responsible for what went on behind the scenes at the company.

Jason Leopold is the Deputy Managing Editor at Truthout. He is the author of the Los Angeles Times bestseller, News Junkie, a memoir. Visit newsjunkiebook.com for a preview.

|

|

|  |