|

|

|

Travel & Outdoors | July 2005 Travel & Outdoors | July 2005

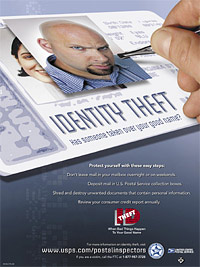

Don't Let Identity Thieves Ruin Your Trip

Jennifer Mulrean - msn.com Jennifer Mulrean - msn.com

| | A day in paradise can turn into a financial disaster if your identity is stolen on a vacation trip. |

When Claudia, 45, closed the door to her Virginia hotel room four years ago, she had no idea she'd just left herself wide open to identity theft and years of ensuing turmoil. Inside, on the hotel bed, was a completed credit-card application, ready for anyone to find.

Unfortunately for Claudia, who asked that her last name not be used, an unscrupulous hotel maid found the application and used the information it contained to wreak havoc on her life.

"She got a hold of it and pretty much started dismantling my life immediately," Claudia says.

Claudia notes that the application contained her Social Security number, date of birth and her mother's name - all that was needed to gain access to her private information. Not only did the maid acquire and run up the credit card for which she'd found the completed application, she also reopened old accounts dating back to the 1980s. And she changed key elements of Claudia's identity and credit records, including her birthdate and contact information.

All told, the credit abuse totaled a couple of thousand dollars, but that doesn't account for the lost income or health problems Claudia says she endured while dedicating herself to straightening the mess out. "It's very violating," she says. "My whole family has been affected by this."

It's hard enough to protect your identity from computer hacking and phishing attacks on your home turf. When traveling, it's even more difficult to keep sensitive financial information locked away, and it isn't as easy to log onto credit and bank accounts to monitor them for suspicious activity. But if you're not careful, you may be unwittingly exposing yourself to unnecessary risks. Here are the best ways to limit the chances you'll be targeted.

Before You Leave Home

Kevin Coffey, founder of consulting company Corporate Travel Safety and a detective with one of the largest police departments in the country, says the vigilance should begin before you set foot outside your home. He recommends you start with the obvious things, such as locking all windows and doors, leaving radios and lights on, and also asking a friend or neighbor to help make your house look lived in while you're away. This can include bringing in your trash cans off the street and even driving up your driveway to leave tire marks should your home get snow while you're away. Other tips:

Suspend mail delivery. This is done easily enough through your local post office, in person or online. But Coffey doesn't recommend you suspend delivery of your newspaper or any other services, since entry-level employees would then be alerted to the fact that you're out of town. Instead, he'd ask one of his friends to retrieve the newspaper each day - or cancel it entirely.

Don't leave bill payments in your mailbox. Bills usually contain checks and credit-card information, and thieves know this, Coffey says. The only place he puts his bills is directly in a secure mailbox.

Lock up sensitive documents, especially if anyone is accessing your home while you're gone. Should someone abuse your trust or break into your home to steal from you, you may not know it until unauthorized charges start showing up on your accounts. "A lot of thieves are getting smart today, where they have not been stealing the actual card because they know if they steal it, accounts get shut down," Coffey says. Instead, they'll take just the information they need to make purchases over the phone or online, or open new accounts in your name.

Make copies of your passport, medical cards and the credit cards you're taking on a trip. But don't make exact copies. Instead, Coffey and Jay Foley, co-executive director of the Identity Theft Resource Center, say you should cut out the last four digits of your credit card numbers and the last four digits of your Social Security number if it's on your medical card. Also, make sure you copy the back of your credit cards so you have the needed telephone numbers to cancel lost or stolen cards.

Prepay for cars, hotel rooms, etc. "If you can reduce the amount of transactions when you're on the road, you'll be better off," Coffey says.

Bring Only What You Need - And Choose It Wisely

There's no reason to bring a wallet or purse that's loaded down with extra credit cards and other sensitive information. Take these steps:

Clean out your wallet. Foley and Coffey recommend carrying no more than a couple of credit cards and an ATM card. But most importantly, Coffey says, "Make sure you do not carry your Social Security number." If you have a military ID, this may be impossible. But most people can avoid risk by bringing the copy they made of their medical card with the last four digits missing. Also, Coffey says you'd be surprised how many people carry their ATM PIN numbers in their wallets. Don't.

Leave checking-account and other financial information at home. Plenty of business travelers bring bills and other busywork from home to take advantage of downtime. But Claudia's experience certainly sheds light on the risks of doing so. She says she no longer travels with personal information and she advises friends against doing so, as well. She also says she doesn't let anyone in her hotel rooms during her stay. "I can live without someone tidying my bed," she says.

Bring an ATM or stored-value card instead of a debit card. Neither Foley nor Coffey is a fan of debit cards, which can be used like credit cards but take money directly out of your checking account. Instead, both men carry ATM cards, which require the use of a PIN to extract cash. Stored-value cards, such as the new American Express Travelers Cheque Card, are also a good solution, they say, though fees can really add up if you're using it to withdraw cash. For lost or stolen Travelers Cheque Cards, American Express says it can replace the funds within 24-72 hours.

Keep An Eye On What You Bring

"No hotel room should be treated as truly secure," says Foley. Many people are particularly lax about securing valuables such as laptops and cameras, he notes. Think about it: You wouldn't leave your wallet sitting out, but many people will leave a $1,500 laptop in the room. Instead, consider the following:

Use hotel safes to store your valuables, including your wallet, passport and digital camera. Coffey would give the nod to front-desk safes over the in-room variety, but says even the latter are usually effective. But Foley says not all in-room safes are created equal. The best are those with electronic combination locks where you create the combo, he says. Second best is an in-room safe with a barrel key, which looks like a little metal tube with little prongs inside. "But remember," Foley cautions, "There's going to be someone with a copy of that key in the hotel." The least-safe safes are those that use easy-to-duplicate flat keys. No safe at all? You can also bring your own portable safe, usually in the form of a small bag or backpack that's reinforced with wire mesh. They can be secured to a large, fixed object in the room with a cable.

Use money belts or new safety-enhanced fanny packs to carry your passport and wallet. These have extras like braided steel cables in their straps that can't be cut through or carabiners holding the zippers together so they can't be unzipped.

Label your valuables with contact information. Believe it or not, Coffey says, there's a good chance that a misplaced item will be returned to you if there's a way for someone to contact you.

Don't let your credit card out of your sight. This is difficult to do in the U.S., where restaurant waiters routinely run your credit card at a register away from your table. But you can opt to pay with cash or traveler's checks in those situations. Outside the U.S., Foley says, it's quite common for wait staff to bring the credit-card reader to the table.

Be aware of your surroundings, especially in crowds at markets, on subways, buses, etc. If you're carrying a laptop, be extra careful at what Coffey calls transaction locations - hotel front desks or ticket counters where you need to put down your laptop to conduct business.

Keep your receipts. This will make it easier to flag any suspicious transactions when you return home.

Electronic Safety

If you're traveling with a laptop or you're using public computer terminals in Internet cafes or hotel lobbies, you'll want to heed the following:

Don't access your bank accounts, pay bills or complete transactions on public computers. The computer may have been compromised by spyware and keyloggers that can capture your passwords and account information.

Make sure the computer's firewall is enabled. Foley recommends making sure it's both enabled and updated. If you don't feel comfortable doing this on a public computer or don't know how, consider carefully what you access from there. Email is probably OK, provided it doesn't contain sensitive information.

Don't save your login on public terminals. Before hitting that "Enter" key when signing into your email, make sure no checkboxes are selected to save your login and password by default.

Beware shoulder surfers. People can hover behind you and note passwords or other important information. (Take the same precautions at ATMs.)

Use three lines of defense for your personal laptops and PDAs: First, physically secure these devices. Coffey says he never leaves his laptop unsecured, even when he's nearby. He uses a security cable to lock it down. Next, use a password to get into the device, so that someone else can't easily log on and access your data. And finally, you should encrypt the data. "It's not the value of the laptop so much as the value of the data on it," Coffey notes.

When You Return

Before you breathe a sigh of relief that you've had a great trip and managed to come back with all your valuables and financial information intact, double-check your accounts. "The first thing I'd do when I got home is contact my credit card companies and verify the charges that have been made," Foley says. He also checks his bank account withdrawals. If your plans required you to make transactions at public computers, check those accounts and change their passwords. (If you are suspicious that your data may have been compromised, here are the steps to take.)

All of this may sound tiresome, but it's no comparison to how world-weary you'd feel after battling to regain control of your identity.

"There's not a day that goes by when (the maid) is not in my life, in my thoughts," Claudia says. |

| |

|