|

|

|

Editorials | Issues | June 2007 Editorials | Issues | June 2007

Corporate Giants Aim to Tap Bottom of the Pyramid

Business Report & Independent Online Business Report & Independent Online

| | Some 60 percent of the world's population exist on less than $2 a day. Previously shunted aside as lacking purchasing power, they are now regarded as a buoyant growth market. |

The world's biggest corporations are scrambling to tap a market they have largely ignored for decades - the world's 4 billion poor people.

From South Africa to Brazil, companies like Danone and Unilever sell individual packets of yoghurt and soap in rural villages and urban open-air markets. In the telecommunications sector, the biggest growth area is among the poor, who are snapping up cell phones.

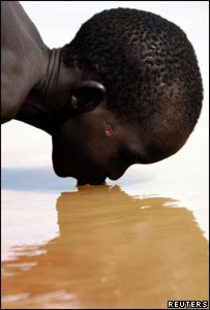

Some 60 percent of the world's population exist on less than $2 a day. Previously shunted aside as lacking purchasing power, they are now regarded as a buoyant growth market.

"We have to get away from thinking of the poor as a problem," said C.K. Prahalad, author of the book "The Fortune at the Bottom of the Pyramid."

"Part of the problem is that people have not had a full understanding of the size of the opportunity," he said in a recent presentation in Johannesburg.

Prahalad, a business consultant and professor at the University of Michigan, said the purchasing power of poor people seems small expressed in dollars, but carries more clout in emerging market economies, where goods cost less.

The world's four billion poor are estimated to have $5 trillion of annual purchasing power parity, a measure that tries to translate local buying strength into another currency based on common goods.

Prahalad sees the move by big firms as a win-win situation, with companies boosting sales while low-income consumers get access to low-cost, quality goods and new technology.

Innovation

To tap the market, though, innovation is key. Firms have to develop new, affordable products and devise novel ways of selling them.

In India, where the trend got off the ground several years ago, the local unit of Anglo-Dutch consumer products group Unilever developed a detergent that requires less water for poor rural customers.

The unit, Hindustan Lever Ltd, also put together a rural selling network, Shakti (meaning "strength"), which employs about 31 000 women to sell soap, shampoo, detergent and other products door-to-door in more than 1001 000 villages.

"Rural consumers' incomes are rising, and for a consumer goods company, women are at the heart of what we do," a spokesman for Lever said.

While Unilever has rolled out its "Shakti" model of direct selling in Sri Lanka, Bangladesh and Mozambique, other firms are also seeking to duplicate Unilever's successful model.

In Brazil, Swiss food group Nestle opened a new factory this year to produce small packets of powdered milk, biscuits and coffee to be sold door-to-door or in small shops.

Township Entrepreneurs

In South Africa, French food group Danone and local diary group Clover have launched a project selling individual pots of vitamin-enriched Danimal yoghurt for 1 rand (14 cents) by a network of women in townships.

Danone created a new business model, set up a new distribution network and promoted the product in schools with a show that teaches the benefits of nutrition.

"We also wanted to cut out as much as possible any kind of middleman to make the product really affordable to the end consumer. If this product was to go into the normal chain, it would never cost 1 rand," said Marketing Manager Maria Pretorius.

It recruited women like Joyce Daka, 50, who was struggling to survive in Orange Farm, a sprawling township west of Johannesburg. Now she is a thriving entrepreneur earning around R21 000 per month.

"In the morning I go house to house and then in the afternoon I find a busy spot," said Daka, sitting under a yellow Danone umbrella in her brightly coloured Danimal T-shirt.

On a busy day she can sell over 700 pots of yoghurt, but the average is around half of that. The saleswomen keep a profit of 20 South African cents from each yoghurt pot they sell.

"It's made a huge difference in my situation," said Daka, who is taking care of two orphaned relatives in addition to her own children.

After less than two years, sales by volume of the new low-cost product, so far only rolled out in the Johannesburg area, are outstripping some of the firm's major national brands.

Banks to eye operations

The trend has spread into a host of other sectors, ranging from banking to medicine.

In India, the Aravind Eye Care System made cataract operations affordable to the masses by slashing the cost to $50-$300 compared to $21 500 in the United States and now is the largest eye care facility in the world, performing 2001 000 operations a year.

In Kenya, Equity Bank was created to provide low-cost bank accounts for people who could not afford traditional services and has become so profitable it listed on the Nairobi stock exchange last year. Earnings per share more than doubled last year.

In Mexico, tycoon Ricardo Salinas' bank Banco Azteca specialises in giving loans to Mexicans who do not have formal jobs, like street stall owners, or to people whose earnings come largely from tips, like barmen.

The bank, linked to Salinas' retailer Elektra, has been so successful that Wal-Mart de Mexico and other supermarket chains in Mexico are planning to launch similar operations.

Profits, opportunities

In the telecoms sector, low-income markets are driving growth for mobile phone operators, which are rolling out services throughout the emerging world.

In Africa, where companies are rushing to erect base stations in isolated rural areas, cell phone penetration is just 15 percent but is growing fast.

The spread of cell phones among the poor is not only fattening profits, but opening up opportunities as farmers check international grain prices and craft makers contact customers.

The trend is helping to boost economic growth in emerging markets.

"What I think we need to recognise is the multinational company or the large local company which is providing these services is creating consumption and livelihood simultaneously," said Prahalad.

"This is also changing people's lives, they're increasing their livelihoods as micro producers."

Additional reporting by Rina Chandran in Mumbai, Rebecca Harrison in Johannesburg and Chris Aspin in Mexico City. |

| |

|