|

|

|

Editorials | Issues | October 2007 Editorials | Issues | October 2007

Microloans Find Homes in America

William F. O'Brien - The Edmond Sun William F. O'Brien - The Edmond Sun

go to original

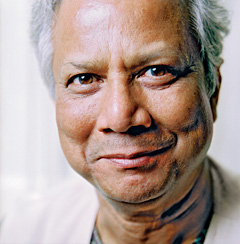

| | Teach a man to fish, and he’ll eat for a lifetime. But only if he can afford a fishing rod. More than 30 years ago in Bangladesh, economics professor Muhammad Yunus (right) recognized that millions of his countrymen were trapped in poverty because they were unable to scrape together the tiny sums they needed to buy productive essentials such as a loom, a plow, an ox, or a rod. So he gave small loans to his poor neighbors, secured by nothing more than their promise to repay. Microcredit, as it’s now known, became a macro success. |

In 1976 an American-trained economist named Muhammed Yunnis in Bangladesh visited a rural village in that South Asian nation where a group of women made furniture. He was curious as to why the women and their families were not prospering despite the fact they were producing quality goods. He found out it was the high rates of interest charged by the local moneylenders that kept them in poverty.

Moved by their plight, Yunnis lent them $27 out of his own pocket to purchase the bamboo they needed to construct the furniture they produced, and that loan was repaid in full. In time, that transaction would result in the creation of the terms “microcredit” and “microlending” in which small loans are made to people with no collateral at low rates of interest and also the formation of the Grameen Bank in Bangladesh by Yunnis.

The economist found that many poor people had marketable skills that were not being utilized and if they had access to capital they could improve their lives by starting small business ventures that would create employment opportunities for others. The Grameen Bank, which translates to “Bank of the Villages” in the Bengali language, made small loans to rural men and women that allowed them to purchase things such as cell phones that they could allow others to use for a small fee.

The vast majority of the loans were repaid, and soon the bank was lending money throughout the nation. The success of the program resulted in the concept of microlending gradually being brought to other parts of the world, and banks similar to the Grameen bank now are found throughout Asia, Africa and South America. In 2006 Yunnis and the Grameen Bank were the joint recipients of the Nobel Peace Prize in recognition of the role that micro-lending has played in improving the lives of millions of people.

There now are micro-lending programs in place in a variety of locations in the United States, including Dallas. As documented in a recent article in the Texas Monthly magazine, the Dallas microlending program began as a result of a speech that Yunnis made to that city’s business leaders in which he told them of how the Grameen Bank had transformed the lives of poor people in Bangladesh. And it would seem that Oklahoma City also would be an appropriate place for such a program. In Mexico and many South American nations that are many people who are part of what economists call the “informal economy” in which they sell goods they produce either out of their homes or on the street.

In recent years, the Oklahoma City area has become home to thousands of Hispanic immigrants, and street vendors of that type are increasingly visible in areas throughout the city. During the summer months, Hispanic vendors with hand carts sell ice cream in the Capital Hill area of South Oklahoma City, and women selling tacos and burritos from cars and trucks are a common site in the city’s Mexican neighborhoods.

Since those individuals tend not to have enough property that could serve as collateral for traditional bank loans, they are unable to transform their operations into businesses with stationary locations where they could develop a stable customer base.

Yunnis found that the women he met with in rural Bangladesh in 1976 where industrious individuals who were knowledgeable about the business that they were engaged in, and the only thing that was hindering them was their inability to obtain financing at a reasonable cost. It would seem that a similar statement could be made about the aspiring Hispanic entrepreneurs who are found on some of Oklahoma City’s thoroughfares.

William F. O’Brien is an Oklahoma City attorney. |

| |

|