|  |  |  Travel & Outdoors | January 2009 Travel & Outdoors | January 2009

Mexico’s Airports See Traffic Fall 5.7% in 2008 Q3

anna.aero anna.aero

go to original

| | As these pictures demonstrate, WestJet has gone to great lengths to focus on its Mexican network in recent months - the Edmonton to Cancun service was launched in November. The carrier also serves the Mexican city from Halifax, Vancouver and Calgary. |  |

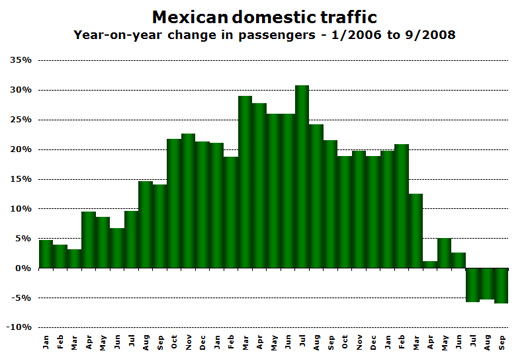

Data for the third quarter of 2008 shows that Mexico’s domestic market has stopped growing, with passenger demand falling by 5.7%. A year previously traffic growth had been around 25%. Not since October 2005 had domestic traffic failed to grow.

Source: DGAC Mexico

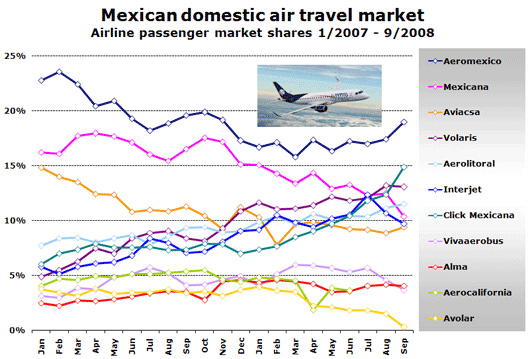

The share of traffic carried on recognised low-cost carriers has once more increased from 43% in the second quarter to around 46% in the third quarter. In September Mexicana, which has ranked second for most of the year in terms of domestic market share, slumped to fifth as it was overtaken by Aerolitoral, Volaris and Click Mexicana. In fact, Mexicana Click (as it now appears to be called after a corporate makeover) is now the second biggest domestic airline by market share.

Source: DGAC Mexico

On 28 October 2008 Avolar was closed down by the government after its operational permit expired. It was operating a fleet of four 737s at the time. On 7 November 2008 Alma ceased operating less than two and a half years since its launch. It operated a fleet of 12 CRJs and was based in Guadalajara. It became the third Mexican airline after Aerocalifornia and Avolar to cease operating during 2008.

International demand falling less quickly; Mexicana expanding

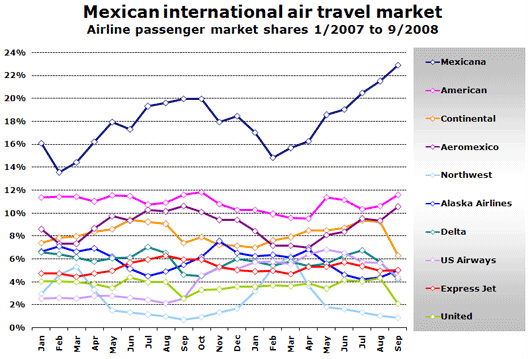

International traffic has also seen a reversal in fortunes with traffic down 1.4% in July and 5.8% in September. However, in August traffic was still up 2.6%.

Source: DGAC Mexico

Mexicana is continuing to stretch its lead as the airline with the highest market share on international routes. In December it launched flights to Orlando and Sao Paulo and will shortly begin scheduled non-stop flights from Mexico City to London Gatwick followed by Madrid in February.

Initial Q4 data confirms traffic decline

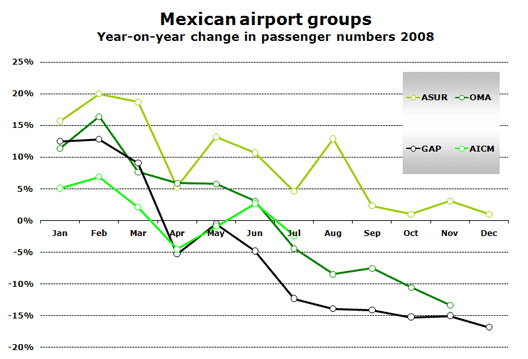

More recent data provided by the operators of Mexico’s airports shows that two of the three major airport groups in Mexico reported a fall in traffic in Q4. Outside of Mexico City the country’s major airports are operated by one of three companies.

Organisation - 2007 passengers - Main airports - (2007 pax)

• ASUR 16.2 million across 9 airports Cancun (11.3m), Merida (1.3)

• GAP 23.6 million across 12 airports Guadalajara (7.3m), Tijuana (4.7m), Puerto Vallarta (3.1m), San Jose Del Cabo (2.9m), Hermosillo (1.3m)

• OMA 14.2 million across 13 airports Monterrey (6.6m), Culiacan (1.1m), Acapulco (1.1m)

Mexico City (AICM) handled 25.9 million passengers last year. These four companies report monthly traffic statistics which are summarised below.

Source: AICM, ASUR, GAP, OMA

Only ASUR, whose biggest airport is Cancun, has reported growth in the last quarter of 2008. Cancun’s traffic grew by 6% in December but this was primarily thanks to international traffic which was up 11.1% while domestic traffic at the airport was down 6.3%. In recent months Cancun has seen new international services from Delta (Nashville), jetBlue (Tampa and Washington Dulles) and WestJet (Edmonton). AirTran will begin daily flights to Atlanta in February and weekend flights to Baltimore/Washington in March.

Frustratingly, AICM has yet to report figures beyond July but should have benefited from the decision by Interjet to re-assign several of its Toluca-based aircraft to Mexico City after the airline bought Aerocalifornia’s landing slots. Using them it started 11 domestic routes. Not surprisingly this has impacted on Toluca’s traffic. After reporting double-digit growth in August, year-on-year passenger numbers fell at Toluca in September and October, though by less than 5%. |

|

|  |