|

|

|

Business News | March 2005 Business News | March 2005

Grupo Mexico to Invest $450 Million to Boost Copper Output

Bloomberg Bloomberg

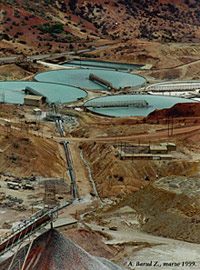

| Cananea copper mine waste water treatment plant.

|

Grupo Mexico SA, the world's third-largest copper producer, plans to invest $450 million during the next two years to boost output and may seek acquisitions.

The funding will help the Mexico City-based company expand at the Cananea mine in northwest Mexico, said Eduardo Gonzalez, chief financial officer of Southern Peru Copper Corp., Grupo Mexico's biggest unit. Grupo Mexico also will look for opportunities to buy companies in Latin America, he said.

Grupo Mexico's planned expansion, which still requires board approval, is a bet on higher copper prices and continued demand from China and the U.S. that helped boost prices to 15-year highs, said Marc Bonter, a precious metals analyst with the London-based consulting firm CRU International. Chile's state- owned Codelco, Phelps Dodge Corp. and Freeport-McMoRan Copper & Gold Inc. also plan to boost production, he said.

"We will be a significant provider of raw materials to the Chinese and certainly to the U.S. at a low cost and a great return," Gonzalez, 36, said in an interview March 16 at his Mexico City office. Gonzalez, the former CFO of Grupo Mexico, was appointed a director of Southern Peru on March 11 as part of a reorganization of the company.

Grupo Mexico's planned $450 million investment over the next two years compares with $180 million that Freeport McMoran Copper & Gold plans to spend this year on capital expenditures, including expansion. Freeport McMoran's Grasberg copper and gold mine in Indonesia is the world's second biggest copper mine after Escondida in Chile.

Copper production is forecast to rise by 1 million metric tons more to 15.7 million tons this year and just under 1 million tons in 2006, which is still lower than demand, Bonter said.

"Grupo Mexico has a very large reserve position and they're sitting on a lot cash," Bonter said.

Southern Peru shareholders on March 28 will vote on a proposal to reorganize the company's assets. Under the plan, Southern Peru will buy Grupo Mexico's Minera Mexico unit for about $3 billion in stock and Grupo Mexico will increase its stake in Southern Peru to 75 percent from 54 percent.

The changes will make Southern Peru the second-largest publicly traded copper producer by market value and give the company the financial strength to pursue acquisitions, Gonzalez said.

"We're combining all the Latin American, low-cost, long- life mining assets into one," said Gonzalez, who holds degrees from the University of Arizona and the University of Chicago and studied politics and economics at Oxford University.

Production

Grupo Mexico forecasts copper production from its Southern Peru and Minera Mexico units will fall to 705,000 metric tons this year from 718,000 metric tons in 2004.

Gonzalez declined to say how much production the company plans to add, saying it wouldn't be enough "to affect the balance of supply and demand."

Grupo Mexico cut production costs to about 30 cents a pound this year from more than 50 cents a pound in 2001, when copper prices plummeted to a 14-year low of about 60 cents per pound.

The company's average copper sale price rose to $1.30 per pound in 2004 from 81 cents the previous year, helping it post record net income of $782 million in 2004 after losses the previous year. The company has the cash to pay for expansion without borrowing, three years after it defaulted on more than $1 billion of debt, said Gonzalez, who helped negotiate the company's restructuring with creditors.

Rising Shares

Rising metal prices helped send Southern Peru's shares in New York 27 percent higher since the beginning of the year while Grupo Mexico's shares have climbed 14 percent in Mexico City. Southern Peru's shares fell $1.32, or 2.2 percent, yesterday to $59.90. Grupo Mexico's shares gained 37 centavos, or 0.6 percent, to 64.24 pesos.

Southern Peru's stock gains caused losses for short sellers -- investors who borrowed and sold the stock to profit from lower prices. Fifty-two percent of the company's shares available for trading were sold short as of Feb. 10. The figure was the sixth highest among almost 1,200 U.S.-listed companies that were sold short, according to Bloomberg data.

"Mining shares are very speculative," said Federico Rangel, who helps manage $1.1 billion of Mexican stocks and bonds at Operadora de Fondos Lloyd SA in Guadalajara, Mexico. "We don't like to bring this kind of volatility to our funds."

Following shareholder approval of the reorganization, Southern Peru will have debt of $1.3 billion, cash of $900 million and earnings before interest, taxes, interest and depreciation -- a measure of cash flow known as Ebitda -- of more than $1 billion, Gonzalez said.

The company will be able to invest in expansion projects, pay a dividend of as much as 50 percent of net income and seek acquisitions, he said.

"If we are able to make the company bigger and more profitable, we will of course do it," said Gonzalez, whose office is adorned with model World War II tanks. "We would be naive in saying we would not be looking for that chance."

Grupo Mexico, which also owns Phoenix-based copper producer Asarco Inc. and a Mexican railroad, plans to use profits this year to pay about $330 million of debt owed by the holding company, Gonzalez said. At the end of last year, the company had debt less cash on hand of $1.55 billion compared with $2.43 billion in 2003, he said.

Share prices for both companies have room to rise because world economic growth will keep copper prices high, fueling profits and allowing them to strengthen finances, said Jose Miguel Garaicochea, who helps manage about $450 million of equities, including Grupo Mexico shares, for the Mexican unit of Banco Santander Central Hispano SA.

"All this good news about Grupo Mexico hasn't been discounted in the market," he said. "The valuation of the company is very attractive." |

| |

|