|

|

|

Business News | June 2005 Business News | June 2005

Mexico's Core Inflation Falls to Record Low in May

Wire services Wire services

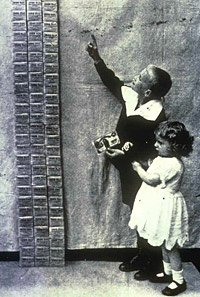

| | During the German inflation of 1923, one dollar was worth 100,000 German marks. |

Core inflation rate fell to a record low in May, adding to speculation the central bank will begin cutting interest rates.

The country's 12-month core inflation rate, which excludes fruit, vegetable and electricity prices, fell to 3.42 percent, the lowest since the central bank began calculating the index in 1983, from 3.46 percent in April. Core consumer prices rose 0.21 percent in May. Summer electricity subsidies that take effect every May led overall consumer prices to fall 0.25 percent last month, helping keep the annual rate at 4.6 percent.

Inflation is easing after Banco de Mexico raised the benchmark loan rate in 12 of the past 15 months, to 9.75 percent, curbing growth in Latin America's biggest economy. Guillermo Aboumrad, a Citigroup Inc. economist, said inflation will be low enough by September to allow for a rate reduction.

"They've done what they could to bring inflation down," Aboumrad, head of treasury research at Citigroup's Banamex unit in Mexico City, said in a telephone interview. "Interest rates are extremely high compared to any emerging market of the same credit quality, and given that the U.S. may no longer raise rates as much as people expected, Mexico will have to cut."

SLOWER GROWTH

Consumer prices fell more than economists surveyed by Bloomberg expected, while the core index was close to forecasts. The median estimate of 20 economists surveyed was for a decline of 0.21 percent for May's headline inflation rate. The core rate was expected at 0.20 percent, according to the median forecast of 17 economists. Mexico targets inflation of 3 percent, plus or minus 1 percentage point.

The nation's US677 billion economy grew 2.4 percent in the first quarter, less than half of the rate in the previous quarter, dragged by the interest-rate increases and less U.S. demand for its exports. Retail sales growth slowed to 4.4 percent in March from 7 percent in December after the central bank almost doubled the overnight loan rate from 5.5 percent in February 2004.

"We're feeling a slight deceleration in economic activity after the interest-rate increases, but maybe next year things will pick up again because of the presidential election," Manuel Cullen, investor relations director at Grupo Gigante SA, the nation's No. 3 retailer, said in a telephone interview in Mexico City.

Competition has kept Mexican companies from raising prices as much as the increase in raw materials, which has hurt profit margins, said Gerardo Canavati, chief financial officer of Grupo Herdez SA, Mexico's largest producer of packaged foods.

Herdez boosted prices an average of 5 percent in the first quarter on its canned vegetables, sauces and other foods to make up for higher costs of aluminum and steel cans, plastic bottles and vegetable oil, he said.

"These price increases don't compensate for the pressure on gross margins because of the increases in commodity prices, but it helps cushion the impact," said Canavati, 38. Herdez doesn't plan to raise prices again this year, he said.

Banco de Mexico Governor Guillermo Ortiz told reporters in Mexico City on May 26 that his repeated interest-rate increases helped keep last year's higher international prices for raw materials from pushing up wages and inflation expectations. That lessened "the need to continue a restrictive policy," he said.

The average forecast for 2005 growth fell to 3.6 percent from 3.8 percent in the central bank's monthly survey of 31 economists published on June 2. Banco de Mexico said on May 27 it maintains its forecast that the economy will grow as much as 4 percent this year.

PESO BONDS

A weakening economy and slowing inflation are luring investors into the peso bond market. The nation's 5- and 10- year peso bonds rose today, pushing yields to the lowest in almost four months. The 5-year yield fell to 9.37 percent from 9.45 percent yesterday and the 10year return fell to 9.6 percent from 9.69 percent at 4:15 p.m. New York time, according to Santander Central Hispano SA's Mexican unit.

The yield on the peso bond due in December 2009 has been below the central bank's one-day rate since May 20, reflecting expectations for rate cuts.

Housing costs and processed food products are leading the slowdown in Mexico's core inflation, which also tracks the cost of services such as restaurants and non-food merchandise including TV sets and cameras.

The annual pace of increase in residential rent and house prices slowed to 2.47 percent in May from 3.69 percent in December. A 21 percent decline in steel prices this year helped cheapen building materials.

Processed food products slowed the pace of increase to 5.5 percent from 7.04 percent in the same period. Gigante's Cullen said there have been smaller increases in the price of groceries including canned foods and instant soups and pastas, and even price reduction in some cases.

"Weather conditions have been favorable and that's translating into less inflation in food products," said Salvador Moreno, economist with ING Groep NV. |

| |

|