|

|

|

Business News | August 2005 Business News | August 2005

Chinese Chiles Chilling Mexico Farmers

Sean Mattson - Express-News Sean Mattson - Express-News

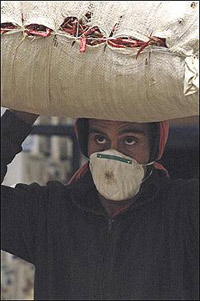

| | Eduardo Delgadillo Garcia, a Spices Moy employee, carries a sack of Chinese chiles. (Photo: Monica Rueda) |

Manalisco, Mexico They used to say here that if a man is wearing a new wide-brimmed hat, he's either a drug trafficker or a chile farmer.

Roberto Gonzalez's sombrero has gathered a decade's worth of grime since he gave up chile farming. Covered with dust from mixing mortar in his construction job, he swears repeatedly about the global market forces that drove him from his "good, honest living" in agriculture.

Gonzalez, 65, is among the thousands of farmers who have stopped producing dehydrated peppers in recent years as one of this nation's most emblematic agricultural traditions has faltered.

The problem? Fierce international competition that began in the late 1990s when peppers from China appeared at the central market in Guadalajara, about 90 miles away.

The Mexican cooking staple from across the Pacific retailed for a fraction of Gonzalez's wholesale price.

The trickle soon became a flood. Between 50 percent and 80 percent of the dried peppers now sold in Mexico are imported, according to wholesalers and industry analysts.

Abroad, Mexico is losing market share as its top customer for peppers, the United States, increasingly is looking to China and recently Peru, Chile and parts of Africa to meet demand. India long has been the top U.S. chile provider but also is seeing its piece of the American pie shrink due to Chinese competition.

Spice-crazy Mexico, where demand for dried chiles has outpaced the country's ability to produce them for years, had time enough to see it coming.

Chile farmers used to be as rich as narcotraficantes because their product was bought and sold like contraband, said Andres Siordia, 51, a retailer at the market in Guadalajara.

"If you wanted two or three sacks, they'd sell you only one," said Siordia, standing between two bins of nearly identical dried chiles.

One had deep-red chiles de arbol from the Manalisco region at 60 pesos per kilogram. The other had the slightly paler chile chino Chinese chiles for half the price.

"If it wasn't for the Chinese chiles, the Mexican chiles would cost 120 pesos" per kilogram, he said.

Mexico also has failed to take advantage of soaring demand in the United States.

Total imports of dried chiles to the United States have doubled in 10 years, according to U.S. government statistics. But Mexico's share of the U.S. import market for a peppers category that includes chile de arbol fell to 16.1 percent in 2004 from 32.5 percent in 1999.

Tim Bolner, production manager for San Antonio-based Bolner's Fiesta Products, is one buyer who has changed allegiances.

Ten years ago, he bought about 80 percent of his dried peppers from Mexico, he said. Now he estimates only 20 percent of his chiles are Mexican.

Bolner blamed erratic supply south of the border.

"When there's any kind of shortage in Mexico, their Mexican market price goes up to absurdly high levels," he said. "They've made a huge vacuum in the last 10 years for the rest of the world to get into those items."

This year, chile prices in Mexico have skyrocketed again due to low production. The high prices drove away customers at Rudy Fernandez Produce in San Antonio, which stocks six varieties of dried chiles.

"People are not using it that much because it is too expensive," said owner Rudy Fernandez, adding he so far has resisted offers to buy cheaper peppers from other countries.

Customers "wouldn't like it," he said. "I wouldn't like the stuff coming from somebody else when we have an abundance of our own."

Varieties, the spice of life

Chiles originated in South America, and some researchers suggest the plant was first domesticated in Mexico. Chile seeds came to Europe in 1493 and the plant spread throughout the world. There are more than 100 varieties, including bell peppers and jalapeρos. Mexico is a leader in fresh pepper production, with a strong U.S. market.

China and India mainly produce dehydrated peppers similar to Mexico's sleek red chile de arbol, used in flaming hot salsas or sprinkled crushed onto food.

Mexico maintains an advantage over other chile-producing countries in raising numerous kinds of specialized dried peppers such as the chile ancho or Anaheim pepper, a sweet pepper used in mole sauces. Mexico dominates world production and accounts for 99 percent of U.S. imports.

But a glance at chile bins in Mexican markets suggests the rest of the world wants a piece of the action.

For the first time, Chinese imports that resemble Mexico's mirasol pepper, also used in mole dishes, showed up at Guadalajara's central market this year, vendor Siordia said. He sells the pepper for about half its Mexican equivalent.

Anaheim peppers from Peru also appeared last month, wholesaling for about 30 percent less than its Mexican-grown counterpart.

Some of the packaged chile ancho sold in Mexican Wal-Marts is from Peru.

But Mexico's biggest concern is China and its dirt-cheap labor force.

"The fear is that they copy more chiles," said Carlos Armando Zarate, head of imports for Spices Moy in Guadalajara, which imports chiles de arbol from China, exports Mexican chiles to the United States and has a chile production operation in Zacatecas.

China's revaluation of the yuan on July 21 which led to a mere 2 percent appreciation in the currency after 11 years of being pegged to the dollar will increase the price of Chinese chiles, though not enough to have a major impact, Zarate said.

"It's going to make Chinese products more expensive," he said. "But I don't believe the impact will be considerable."

China's ability to "copy" specialized peppers is unclear, but the attempt is under way. Mexico and the United States have registered small amounts of imported Chinese Anaheim chiles.

Zarate says one of his top competitors has moved its chile production to China, and his main Chinese supplier advertises plant "breeding" on its Web site. Both companies refused to comment for this report.

Chinese end run?

One reason many chile importers in Mexico are guarded about their operations might have to do with how many Chinese peppers make it to Mexico via the United States to avoid a 20-percent duty applied by Mexico, industry insiders say. Some $13.5 million worth of dried chiles came to Mexico from the United States in 2004, which was 13 times the amount imported in 1990, according to Mexican government figures.

"We know these chiles are not being produced in the United States," said Jose Manuel Gochicoa Matienzo, a producer and president of Mexico's Chile Council.

The evidence suggests he's right.

For one thing, U.S. production of dried peppers has been flat in recent years, since American producers, based mainly in New Mexico, also have struggled with foreign competition.

And most U.S. peppers are grown for domestic consumption, said Lou Biad, a major producer based in Las Cruces, N.M.

Gochicoa said he wants the Mexican government to seek sanctions against the United States for the "triangulization" of peppers and pass laws prohibiting or strictly limiting foreign imports.

Mexican government officials said neither option is being considered.

James Libbin, an agricultural economist from New Mexico State University in Las Cruces, said Mexico will have to tackle foreign competition head-on by mechanizing its labor-intensive chile industry. A combination of mechanization and cheap labor is what has made South American chile production viable, he said.

In Mexico, each hectare (2.5 acres) of chiles needs 275 days of labor per production cycle, according to Gochicoa and labor is exponentially more expensive in Mexico than in China or India.

"How can you compete with a country that's paying its labor less than a dollar a day?" Libbin said. "And, in the long run, you can't. But of course that won't last, either. Just as in Mexico ... folks find better alternatives (and) they leave the fields. That'll happen in China and India and Peru, as well."

"But in the meantime, it sure hurts."

Mechanization still is the furthest thing from the minds of most chile producers in Mexico. As with countless other agricultural industries, most Mexican chile producers are small-scale, disorganized and exploited by intermediaries who monopolize market access.

The middleman accounts for 30 percent of the product's final price tag, said Octavio Santiago Velasco, a University of Chapingo specialist in agromarkets.

Modernizing distribution channels would be a giant step toward making Mexico chile producers more competitive, he said from the school near Mexico City. |

| |

|