|

|

|

Business News | May 2006 Business News | May 2006

Jury Convicts Enron's Skilling and Lay

Carrie Johnson - Washington Post Carrie Johnson - Washington Post

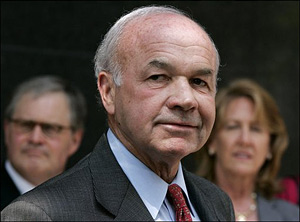

| | Enron founder Kenneth Lay flanked by his attorney George "Mac" Secrest, left, and his wife Linda leaves the courthouse after his banking fraud trial as the jury continues to deliberate his fate in his fraud and conspiracy trial in Houston. (AP Photo/Pat Sullivan) |

Houston, TX - A federal jury today convicted former Enron chairman Kenneth L. Lay of each of the six counts with which he was charged and convicted his protege Jeffrey K. Skilling of 19 of 28 counts, holding the top executives accountable for fraud on their watch.

The jury returned to the courtroom after deliberating for fewer than six days over a trial that took almost four months, avoiding eye contact with the two defendants and their families. After the verdicts were read, U.S. District Judge Simeon T. Lake III also found Lay guilty in a separate case of four counts of bank fraud.

Lake set sentencing for both men for Sept. 11.

As the verdict was read, Lay stood in the front of the courtroom near a bench he had occupied along with his wife, Linda, and daughter, Elizabeth Vittor, both of whom began to weep. Other family members sat in the front row among the spectators in the courtroom.

Skilling was impassive. He held his hands pressed together in front of him. After the verdict, he exchanged words with brother, Mark, and his defense attorney, Daniel Petrocelli. Skilling was the first man out of the courtroom, immediately after the judge left the bench.

After the verdict, Lake said that Lay would be required to relinquish his passport and he set a bond hearing for later in the afternoon for Lay. Skilling is already free on a $5 million bond.

Skilling and Petrocelli appeared at microphones set up on the courthouse steps just minutes after the verdict was read, saying they would offer a "full and vigorous" appeal.

"We have just begun to fight," Petrocelli said, standing beside his client who appeared composed as he thanked his family, his lawyers and the news media for their conduct during the trial.

Several hours later, Lay appeared outside the courthouse, too, and made a brief statement. "Certainly, we're surprised and probably more appropriate to say we're shocked. I firmly believe I'm innocent of these charges," Lay told reporters and camera crews assembled outside the courthouse. "Despite what happened today, I am still a very blessed man. . . . Most of all, we believe in the fact that God is in control."

Skilling, 52, and Lay, 64, once stood near the pinnacle of American business, as the energy trading powerhouse they created out of a stodgy pipeline company grew to become the nation's seventh largest public company. But their fortunes collapsed in a heap along with the business in December 2001.

Now the two men, who together invested close to $70 million in their defense, face the possibility of spending the rest of their lives in prison and living in history as the ringleaders of a fraud at a company whose name became synonymous with accounting tricks and rule-breaking.

Enron's bankruptcy filing cost thousands of workers their jobs, spooked investors into doubting the integrity of the stock market and spurred lawmakers to enact the most significant changes to corporate practices in more than 70 years. The verdict comes at the very moment business groups are seeking to overturn those changes in the courts and within federal agencies.

In Washington, Deputy Attorney General Paul J. McNulty called the convictions a "tremendous win" for prosecutors and for Enron employees, who "lost their jobs and their pensions, and investors who lost their savings."

"At a time when the company was foundering, these defendants perpetrated a lie that Enron was a robust and growing company in the strongest financial condition it had ever been in, as they knew the truth was something very different," he said.

"The message of today's verdict is simple," McNulty said. "Our criminal laws will be enforced just as vigorously against corporate executives as street criminals."

Several members of the jury, interviewed on CNBC, said the testimony by Lay and Skilling was not convincing.

Wendy Vaughan, who runs two businesses herself, said she "very, very badly wanted to believe" the defendants' testimony. But, "in places in their testimony, I felt their character was questioned."

Freddy Delgado, an elementary school principal, said the jury "kept going back" to the testimony of former Enron treasurer Ben F. Glisan, who placed Lay and Skilling at the scene of illegal activities.

During the trial, Lay and Skilling advanced a profoundly risky defense strategy. In essence, they argued that the company fell into bankruptcy not because of fraud but because of a market panic fueled by skeptical news reports, investors who predicted the stock price would drop and concerns about the ethics of then-finance chief Andrew S. Fastow.

Both Lay, who once mingled with members of the Bush family and earned the nickname "Kenny Boy" from President Bush, and Skilling, who during boom years persuaded Wall Street analysts of Enron's genius and his own, took the witness stand in an effort to deploy their legendary salesmanship on their own behalf. But, in a total of 14 days of testimony, neither man proved convincing, jurors said.

The eight-woman, four-man jury took less than six full days to issue its verdict, after hearing evidence over 16 weeks from 56 witnesses. None, jurors said, mattered more than the defendants themselves. In contrast to his grandfatherly, genial public image, Lay angrily attacked prosecutors for deigning to investigate his $77.5 million of stock sales. Skilling failed to explain personal stock trades, suffered memory lapses about key events and tried to outwit the government by spinning long explanations for such things as problems in Enron's retail and Internet broadband units.

Federal prosecutors prevailed despite the lack of documents that directly linked the men to a scheme to boost earnings and conceal billions of dollars in debt. From the start of the trial Jan. 30, government lawyers signaled they would skim over arcane business issues and instead focus on whether the defendants misled analysts and investors in a series of optimistic public statements designed to prop up Enron's stock price.

Skilling, whom prosecutors characterized as the mastermind of the fraud, resigned abruptly in August 2001, passing the torch back to his mentor. Skilling faced 28 charges, including insider trading, conspiracy and securities fraud. Lay faced six more narrow charges based on his leadership of the company after he stepped in to fill the void, a decision he testified that he regretted bitterly in the years that followed. Years in the making, the Enron investigation has been the most sophisticated and painstaking white collar criminal probe in history, Justice Department officials said, producing 23 other convictions. Enron's collapse also helped topple accounting firm Arthur Andersen LLP, convicted of obstructing justice for tampering with documents related to Enron in 2002. The U.S. Supreme Court unanimously overturned the verdict last year because of faulty jury instructions - one of many issues Lay and Skilling are likely to argue in their own extensive appeals.

Enron's implosion in late 2001 put substantial pressure on the Bush administration, which had developed close ties to Lay, to distance itself from business malfeasance. Within months, President Bush mobilized federal agencies and launched a corporate fraud task force that has convicted more than 900 people, including 92 corporate presidents, 82 chief executive officers, 40 chief financial officers, 14 chief operating officers, and 17 corporate counsel or attorneys.

The government victory could give new ammunition to investor advocates who are trying to make directors more accountable.

"This was the most important corporate scandal of our lifetimes," said securities law historian Joel S. Seligman. "It was one of the immediate causes of the Sarbanes-Oxley Act, the governance reforms of the New York Stock Exchange and NASD, and the most consequential reorientation of corporate behavior in living memory."

Rep. Michael G. Oxley (R-Ohio), co-author of the act named for him and Sen. Paul S. Sarbanes (D-Md.), applauded the trial result. "The jury's verdicts help to close a notorious chapter in the history of America's publicly traded companies" he said, according to an Associated Press report. "Appeals aside, the end of the trial will mark the end of a dark era."

The case has been a major media preoccupation here in Houston. After the verdicts were announced, the Houston Chronicle put out a special edition of the paper.

Both defendants have yet to resolve civil lawsuits filed by former shareholders who seek billions of dollars. But they may have to stand in line behind the federal government, which has sought the forfeiture of Lay's $4 million penthouse apartment and Skilling's $5 million Mediterranean-style mansion, among other assets.

Staff writer Frank Ahrens contributed to this report. |

| |

|