|

|

|

Business News | August 2006 Business News | August 2006

US Recession Will Be Nasty and Deep, Economist Says

Rex Nutting - MarketWatch Rex Nutting - MarketWatch

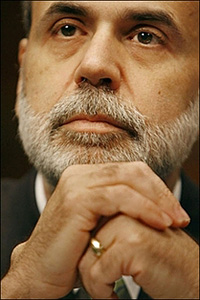

| | Federal Reserve Chairman Ben Bernanke seen here on Capitol Hill 19 July, 2006 in Washington, DC. President George W. Bush dismissed fears of a US recession and expressed confidence that Federal Reserve chairman Ben Bernanke can ward off inflation without killing growth. (AFP/Chip Somodevilla) |

Housing is in a free fall and is pulling the economy down with it, Roubini says.

Washington - The United States is headed for a recession that will be "much nastier, deeper and more protracted" than the 2001 recession, says Nouriel Roubini, president of Roubini Global Economics.

Writing on his blog on Wednesday, Roubini repeated his call that the U.S. would be in a recession in 2007, arguing that the collapse of housing will bring down the rest of the economy.

Roubini wrote after the National Association of Realtors reported Wednesday that sales of existing homes fell 4.1% in July, while inventories soared to a 13-year high and prices flattened out year-over-year.

"This is the biggest housing slump in the last four or five decades: every housing indictor is in free fall, including now housing prices," Roubini said. The decline in investment in the housing sector will exceed the drop in investment when the Nasdaq collapsed in 2000 and 2001, he said.

And the impact of the bursting of the bubble will affect every household in America, not just the few people who owned significant shares in technology companies during the dot-com boom, he said. Prices are falling even in the Midwest, which never experienced a bubble, "a scary signal" of how much pain the drop in household wealth could cause.

Roubini is a professor of economics at New York University and was a senior economist in the White House and the Treasury Department in the late 1990s. His firm focuses largely on global macroeconomics.

While many economists share Roubini's concerns about the imbalances in the global economy and in the U.S. housing sector, he stands nearly alone in predicting a recession next year.

Fed watcher Tim Duy called Roubini the "the current archetypical Eeyore," responding to a comment Dallas Fed President Richard Fisher made last week in referring to economic pessimists as "Eeyores" (after Winnie the Pooh's grumpy friend).

"By itself this slump is enough to trigger a U.S. recession: its effects on real residential investment, wealth and consumption, and employment will be more severe than the tech bust that triggered the 2001 recession," Roubini said.

Housing has accounted, directly and indirectly, for about 30% of employment growth during this expansion, including employment in retail and in manufacturing producing consumer goods, he said.

In the past year, consumers spent about $200 billion of the money they pulled out of their home equity, he estimated. Already, sales of consumer durables such as cars and furniture have weakened.

"As the housing sector slumps, the job and income and wage losses in housing will percolate throughout the economy," Roubini said.

Consumers also face high energy prices, higher interest rates, stagnant wages, negative savings and high debt levels, he noted.

"This is the tipping point for the U.S. consumer and the effects will be ugly," he said. "Expect the great recession of 2007 to be much nastier, deeper and more protracted than the 2001 recession."

He also sees many of the same warning signs in other economies, including some in Europe.

Home Sales Fall to 2-Year Low

Bloomberg News

July sales of existing houses nationwide are are off 11.2% from '05 as the stock of unsold homes sets a record.

Sales of previously owned U.S. homes fell in July to the lowest in more than two years, a slowdown that could influence the Federal Reserve to keep interest rates steady for a second month.

Purchases declined 4.1 percent, more than economists forecast, to an annual ra?e of 6.33 million, the National Association of Realtors said yesterday in Washington. Sales fell 11.2 percent from a year earlier, and the supply of unsold homes climbed to a record.

The report comes a day after Chicago Fed President Michael Moskow said a sharp decline in housing, which by some estimates accounted for more than half of growth during the past three years, would be a risk to the economy. Moskow also warned of higher interest rates to stem inflation, but economists say slackening growth is more likely to stay the Fed's hand.

"This plays into the Fed's hope and forecast that growth is going to stay moderate and that the pressures we are seeing on inflation will be transitory," said Joshua Shapiro, chief U.S. economist at Maria Fiorini Ramirez Inc. in Manhattan. "If they aren't done yet, they are almost finished."

Economist Carl Riccadonna, with Deutsche Bank Securities in Manhattan, said, "Weakness in the housing market will be a drag on consumer spending in the near-to-medium term, thereby permitting the Fed to stay on hold."

Rising mortgage rates, following a surge in prices during the five-year housing boom, have made home purchases less affordable than at any time in almost two decades, according to the Realtors group.

Resales were expected to drop to an annual rate of 6.55 million, the median estimate of 61 economists in a Bloomberg News survey, from June's originally reported 6.62 million.

The number of unsold homes on the market at the end of July jumped to 3.86 million homes, the highest since records began in 1999. There was 7.3 months' supply at the current sales pace, the most since 1993.

The median price of an existing home rose 0.9 percent in July from a year ago to $230,000, the Realtors group said.

Existing home sales account for about 85 percent of the housing market. |

| |

|