|

|

|

Business News | December 2006 Business News | December 2006

Parties Unite, Pass 2007 Revenue Bill

Kelly Arthur Garrett - The Herald Mexico Kelly Arthur Garrett - The Herald Mexico

| | About 1.5 trillion pesos will flow into the government treasury next year from income and sales taxes, including taxes on gasoline, alcoholic beverages, soft drinks, tobacco products and vehicle ownership. |

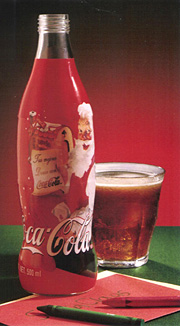

The lower house of Congress approved the income side of the 2007 federal budget Monday, unanimously adopting a 2.264 trillion-peso package that will include a new 5 percent tax on soft drinks and a gradually escalating tobacco tax.

The Chamber of Deputies approved the same government income figure sent up by its Finance Committee, but the amount was 30.7 billion pesos more than called for by President Felipe Calderón´s submitted budget. The increase could facilitate the restoration of education funding that Calderón had sought to cut.

Taxes will account for most of the 2.2 trillion pesos (about U.S. $200 billion). About 1.5 trillion pesos will flow into the government treasury next year from income and sales taxes, including taxes on gasoline, alcoholic beverages, tobacco products and vehicle ownership.

Another 700 billion pesos will come in from non-tax sources, mostly social security premiums and profits from the state-owned oil monopoly, Petroleos Mexicanos, or Pemex. The income estimate is based on a barrel price of US$42.80.

The Mexican budget procedure is divided: First the president proposes, and the Congress approves, an income package that determines how much money the federal government will collect.

The president submits his spending package separately for congressional review.

The most significant figure in the new income package may be the 0 representing the number of "no" votes in the Chamber Monday. The measure passed 425-0 with one abstention. The unanimous vote came 17 days after two feuding political factions - President Calderón´s National Action Party (PAN) and the opposition Democratic Revolution Party (PRD) - literally came to blows on the Chamber floor.

"This shows that the (current) legislature has the will to arrive at agreements that the country needs," said Chamber president Jorge Zermeño, a PAN member.

The cigarette and soft drink taxes remain controversial, however, and members of the Institutional revolutionary Party (PRI) are expected to mount another attack on the measures when they get to the Senate.

The soft drink tax in particular caused rifts within the PAN and the PRD. Even on the eve of the vote Monday, the PAN and PRD party presidents were expressing their opposition to the tax, while key senators in each party were supporting it.

DIVISIONS

Opponents contended that the tax would hit lower income Mexicans the hardest. Proponents cited the ease of collection and the ancillary benefit of reducing consumption of products proven to be health dangers.

In the end, both taxes passed overwhelmingly, though not unanimously. The cigarette tax will work its way up from its current 110 percent to 160 percent in 2009. That´s expected to translate into a peso per pack increase in each of the next three years.

Despite the difference between Calderón´s proposal and the approved version, the unanimous vote gave the president a positive signal early in his administration. His predecessor, Vicente Fox, failed in his attempt to get Congress to pass a national sales tax on food and medicine, and had trouble working with the legislature for most of his term.

The deputies will now turn their attention to the spending side of the budget. |

| |

|