|

|

|

Business News | January 2007 Business News | January 2007

Uncertain Future

Diane Lindquist - San Diego Union-Tribune Diane Lindquist - San Diego Union-Tribune

| | Construction workers on the roof of a new industrial building being constructed in the Mesa de Otay area of Tijuana. (John Gibbins/Union-Tribune) |

Mexico's maquiladoras have recovered from severe losses suffered during Vicente Fox's administration, but industry leaders are worried that new President Felipe Calderón's focus on tourism and other economic sectors will leave them in the global dust.

Without a further easing of onerous government rules and customs procedures, they fear, owners of assembly plants that produce goods for the U.S. market will find India and China much more attractive.

In theory, industry experts say, the maquiladoras could help Calderón achieve his goal of attracting foreign investment to stimulate Mexican economic growth and job creation.

About a third of Mexico's annual foreign investment – $20 billion – flows to the border-concentrated industry. The sector creates more jobs than any other – an average of 50,000 positions a year.

But the new president, who took office Dec. 1, has said little about his plans.

“What will be President Calderón's attitude toward the maquiladoras?” John H. Christman, Mexican director of Global Insight, a worldwide economic, financial and industry forecasting firm, asked recently. “None of the three major candidates made any reference to the industry during their campaigns.”

Since becoming president, Calderón, a career politician who was Fox's energy secretary, has pledged to focus more on domestic sectors, like tourism, as the engine of job growth.

That's worrying, said Christman, a 40-year maquiladora analyst, because Calderón's policies are likely to mold the future of an industry undergoing a crucial transformation.

A government decree in November changed the program under which the maquiladoras operate. It combined the foreign-owned factories with the mostly Mexican companies and suppliers that operate under what is known as the PITEX program. Both are export promotion programs, but they previously operated under separate decrees.

The term maquiladora is being preserved, but the two different types of plants now function under the Decree for the Promotion of the Manufacturing, Maquiladora and Exportation Services Industry, known as the IMMEX program.

According to the government, the combination was necessary to consolidate regulations and legal framework and to simplify administration of the two export-promotion programs.

But industry representatives and experts at a recent San Diego conference on Mexico and China said the new IMMEX program doesn't go far enough to help the industry be globally competitive and, in some instances, hurts it.

“Will (the new decree) stimulate direct foreign investment? Will it speed customs procedures and costs? Will it reduce burdensome government regulations and paperwork?” Christman asked.

“I bet it won't.”

Christman and other maquiladora leaders said Calderón should refine the decree to eliminate remaining impediments and make it easier for foreign and domestic companies and their suppliers to start and maintain manufacturing operations in Mexico. Customs procedures and the corporate tax structure also need to be changed, they said. Energy and labor law reforms should be implemented. And highways, seaports, airports and U.S.-Mexico border crossings should be expanded or created, they said.

Adding more of the recently devised foreign trade zones, in which customs charges and regulations are relaxed, is another instrument that could bring additional foreign companies to Mexico, said Gary Swedback, president of NAI Mexico, a global commercial real estate firm.

Two such zones exist and industry representatives are working to create more, including one in Tijuana.

“They will support increased competition through tariff reduction, less red tape and through logistics and supply-chain mechanisms,” Swedback said.

Such actions are deemed vital to positioning Mexico against India and China in attracting manufacturers who are seeking offshore locales to produce goods for the U.S. market.

India recently undertook a program to add manufacturing to its successful software and tech-support sectors and captured $6 billion in foreign investment in 2005.

China, with generous tax incentives, requirements to integrate domestic businesses and an ambitious highway and seaport development program, gained $60 billion. In 2006, the Asian manufacturing giant displaced Mexico as the No. 2 trading partner with the United States. Canada remains No. 1.

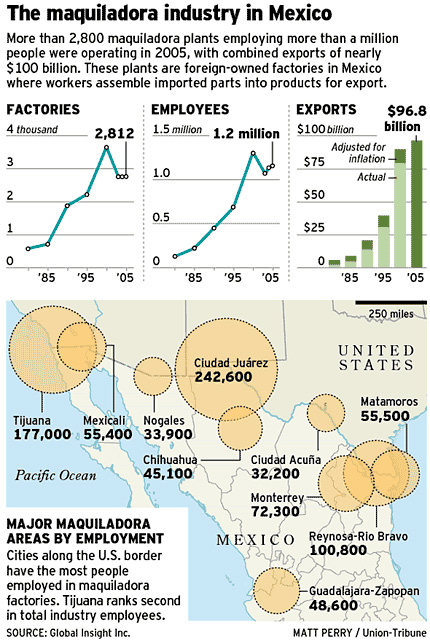

Over the past three decades, Mexico's maquiladora industry, with a current value of $121.5 billion, propelled Mexico into the top ranks of industrialized nations.

The government started the program in 1965 as a way to employ Mexican migrants repatriated at the end of the U.S. bracero guest-worker program. Since then the industry has expanded both geographically and economically.

By 1973, maquiladoras, located mostly in the country's northern urban centers, accounted for nearly half Mexico's export assembly. And by 1985, the maquiladoras had become Mexico's second-largest source of income from foreign exports, behind oil. Growth accelerated even more after implementation of the North American Free Trade Agreement gave investors more confidence about locating in Mexico.

But a crisis hit the industry early this decade when a U.S. recession cut deeply into sales of maquiladora products. At the same time, the Fox administration was introducing an array of confounding policies and urging plant operators at the U.S.-Mexico border to relocate to southern Mexico, which had cheaper wages but little infrastructure geared toward export activities.

Instead, many left. The convergence of forces cost Mexico one-fifth of its maquiladora factories and jobs. Of the 900 plants that closed, a third went to China.

“Mexico chose a bad time to change its policy regarding maquiladoras just as there was a weak U.S. and world economy and China was revving up its industrial policy,” said Nick Criss, industrial services director of the global real estate firm Cushman & Wakefield.

To survive in Mexico, manufacturers turned from low-wage assembly activities to higher-tech manufacturing operations that justified the region's relatively high wages and took advantage of its proximity to the United States.

“The dust is now settling,” Criss said. “We now know the strategic industries that are in Mexico. And they will continue to come.”

Television manufacturers have revamped production lines to produce the new generation of plasma, LCD, and rear-projection TVs. Electronic and electrical material producers, the category television manufacturers fall in, have increased their presence 10.5 percent since 2005. Auto and auto parts makers have grown more than 13 percent.

At the same time, textiles and apparel, which involve simple assembly processes needing little technical skills, have shrunk 23 percent.

“Five years ago, we didn't have aeronautical companies,” said Sergio Ornelas, editor of Mexico Now, a trade publication. “Now there are 110 and they export a half billion in goods a year.”

Suppliers are following these new or expanding companies to Mexico.

Factories are hiring more workers, an average 429 positions per plant. Projections put this year's total at 1,236,600 workers, a 16 percent jump over the number employed in 2003.

“Tijuana continues to top the list by far in terms of number of plants and is in second place in employment behind Juarez,” Christman said.

But without significant measures by Calderón, Global Insight projects only modest growth during the next administration.

Plants will increase only slightly to a bit more than 3,000, the forecasting firm says, while the number of workers will grow to a record 1,445,100. Wages, now at an average of $2.30 an hour, including benefits, are expected to rise by the end of Calderón's term to $2.78.

“From 2006 to 2012, growth will be 2.95 percent,” Christman said. “That's hardly robust.”

Diane Lindquist: (619) 293-1812; diane.lindquist@uniontrib.com

|

| |

|