|

|

|

Business News | August 2007 Business News | August 2007

Hispanics' Hard Times Hit Wal-Mart

Kris Hudson & Ana Campoy - Wall Street Journal Kris Hudson & Ana Campoy - Wall Street Journal

go to original

| CROSSING BORDERS

• Ripple Effect: Wal-Mart's Mexico arm has seen slower sales growth as customers spend less.

• On the Wire: Growth in remittances, an important source of income in Mexico, has slowed as U.S. demand and U.S. housing have softened.

• New Challenge: Wal-Mart, with overall slower sales growth, could see additional pressure in both nations. |

Dallas, TX - Martín Zamorano, a cement worker and Wal-Mart shopper, frequently used money transfers to send $50 to $100 at a time to his 82-year-old mother in the tiny town of Chinanpas in central Mexico.

Now, with local home construction down precipitously from a year ago, he can no longer afford to send even a modest amount. Instead, Mr. Zamorano has been sending cans of peas and corn, packaged soups, and other foods to his mother through a relative who visits Chinanpas frequently.

"Work has dried up," said Mr. Zamorano, 44 years old, as he perused the grocery section of a Wal-Mart near the heavily Hispanic Oak Cliff section of Dallas. "It's been very rainy, and there haven't been a lot of projects."

Mr. Zamorano's plight presents a challenge to Wal-Mart Stores Inc. on both sides of the U.S.-Mexican border. The world's biggest retailer by sales has increasingly relied on purchases by Hispanic shoppers both in the U.S. and in Mexico to fuel its sales growth. In particular, Wal-Mart has sought to draw Mexican and Mexican-American customers in the U.S. who send money to relatives in Mexico using the retailer's growing wire-transfer business. The relatives then have the opportunity to stock up while at their local Wal-Mart-operated store.

But economic jitters - in particular, the softening U.S. housing market - have led to spending cutbacks among many in that group. Estimating the impact on a group as large and varied as Hispanics is difficult. But economists at Deutsche Bank estimate about 500,000 illegal Hispanic workers in construction have lost their jobs last year without showing up in government figures. The industry is heavily Hispanic, legal or illegal: The group makes up 25%, or 2.9 million, of the 11.8 million workers in the U.S. construction industry, according to the Pew Hispanic Center, with about three-quarters of them foreign-born.

"There's less work," says Jesús Manuel Vázquez, a sheetrock installer in Dallas who sends money to his mother-in-law in the state of Chihuahua in northern Mexico every 15 days but recently has cut back.

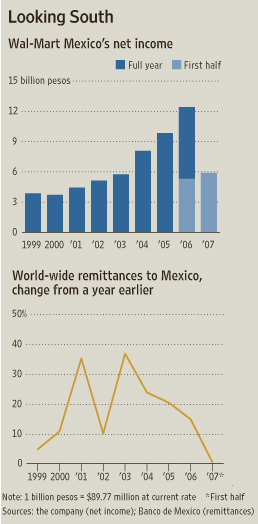

Economists cite the housing market, among other factors, for a drop in those money transfers. The Mexican central bank estimates that money transfers into the country have risen 0.6% so far this year, compared with a robust 15% increase last year and 21% the year prior. Money transfers from the U.S. are estimated by economic-analysis firm Global Insight Inc. to account for 5% of Mexico's consumer spending. Economists cite the housing market, among other factors, for a drop in those money transfers. The Mexican central bank estimates that money transfers into the country have risen 0.6% so far this year, compared with a robust 15% increase last year and 21% the year prior. Money transfers from the U.S. are estimated by economic-analysis firm Global Insight Inc. to account for 5% of Mexico's consumer spending.

The company cited the slowdown in remittances when its Wal-Mart de Mexico SAB unit, often a generator of double-digit percentage gains in sales, posted a more sedate gain of 8.6% in its second quarter ended June 30. The Mexican unit, known as WalMex, noted that it is attracting more shopping visits than a year earlier at its 930 stores, but shoppers are spending less each time and buying necessities rather than discretionary items.

"The Mexican economy is experiencing slowing growth and softening consumer demand," Wal-Mart Treasurer Charles Holley said on a recorded message detailing the retailer's global results for its second quarter ended July 31.

Wal-Mart - which operates under the Bodega Aurrera and Suburbia names, among others, in addition to its flagship Wal-Mart brand - has become the largest retailer by sales by offering a low-cost alternative to relatively inefficient Mexican retailers. WalMex racked up $18.3 billion in sales last year, accounting for nearly a quarter of the retailer's international sales and ranking it as Wal-Mart's second-largest international division behind its Asda unit in the United Kingdom.

The retailer has responded to the slowdown by cutting its spending on advertising and marketing, eliminating jobs at its headquarters and slashing prices on a new round of products on Aug. 16.

The money-transfer slowdown is but one of several factors hampering the Mexican economy. Most importantly, U.S. demand for goods manufactured in Mexico - cars, auto parts and consumer electronics, among others - has eased. "Definitely, the slowdown in the U.S. economy in the first quarter triggered a slowdown in Mexican growth," said Rafael Amiel, a managing director in Philadelphia for Global Insight.

In the U.S., the hit to many Hispanic shoppers adds to a host of other factors, like higher gasoline prices and Wal-Mart's own failed foray into trendy apparel and home decor, that have limited Wal-Mart's sales at established U.S. stores to a paltry 1.9% gain in its fiscal second quarter. (Related article on page B9.) In its home market, Wal-Mart has wooed Mexican immigrants and Mexican-Americans with a combination of low prices on clothes and groceries and a growing array of services such as low-cost money transfers, check cashing and prepaid Visa cards aimed at people without bank accounts.

An estimated 9% of Wal-Mart's U.S. shoppers were Hispanic in 2005, up from 6% in 1997, according to ACNielsen. The company declined to comment on the potential impact on its results.

Other retailers catering to Hispanic shoppers report lulls. Adir International LLC's La Curacao, a closely held chain of eight Hispanic department stores in the Los Angeles area, reports that its sales gains have fallen two to three percentage points from their year-earlier levels. Similarly, the chain's sales of money transfers have slowed. "We're still posting good numbers vis-a-vis last year, but we are starting to see the beginning of a slowdown in consumer confidence," said Mauricio Fux, senior vice president of business development.

Minyard Food Stores Inc., a closely held operator of 26 Carnival Hispanic grocery stores in the Dallas-Fort Worth area, registered a slight pullback in sales gains earlier this year. Chief Executive Officer Mike Byers attributes the slackening to an unusually wet spring in Texas that cut into construction hours and limited the pay received by many Carnival shoppers.

Osiris Rubio, a 21-year-old construction worker in Dallas, has reduced to $1,000 from $1,500 the amount he and his brother send to family in Paracho in central Mexico every 15 days. The market for construction work in the area "is very slow," Mr. Rubio said, standing next to his nearly empty shopping cart in a Dallas Wal-Mart. "I still work five days a week, but there's no overtime. So I get less money."

Mr. Rubio's relatives in Mexico have pared their spending and dipped into their savings to make ends meet. His mother uses the money he sends home to buy groceries and pay school tuition for his two brothers still in Mexico. "We don't spend on any luxuries," he said.

Write to Kris Hudson at kris.hudson@wsj.com and Ana Campoy at ana.campoy@dowjones.com |

| |

|