|

|

|

Business News | October 2007 Business News | October 2007

Crude Oil Climbs to Record Above $93 as Mexico Halts Production

Mark Shenk - Bloomberg Mark Shenk - Bloomberg

go to original

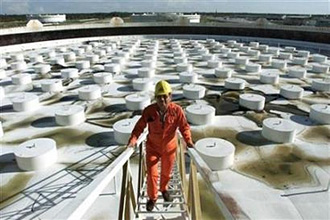

| | An oil worker with Mexico's state owned oil company Pemex in a file photo. Pemex was shutting down about one-fifth of its daily output on Sunday due to bad weather, but said it expects to quickly resume output within days. (Reuters) |

Crude oil climbed above $93 a barrel in New York for the first time after Mexico shut a fifth of its production and the dollar fell to a record low.

State-owned Petroleos Mexicanos, or Pemex, halted about 600,000 barrels a day of output as a storm passed through the Gulf of Mexico, spokesman Carlos Ramirez said in Mexico City. Early today, the dollar dropped to $1.4426 per euro, the weakest since the introduction of the 13-nation common currency in 1999.

"Such a massive shut-in by Pemex is bad for the market because they are such an important supplier to the U.S.," said Addison Armstrong, director of market research at TFS Energy LLC in Stamford, Connecticut. "There are no bearish factors in the market right now."

Crude oil for December delivery rose 52 cents, or 0.6 percent, to $92.38 a barrel at 10:13 a.m. on the New York Mercantile Exchange. Futures climbed to $93.20, the highest since trading began in 1983. Oil is up 52 percent from a year ago.

Brent crude oil for December settlement rose 70 cents, or 0.8 percent, to $89.39 a barrel on the London-based ICE Futures Europe exchange. Brent reached $90, the highest since trading began in 1988.

The oil market "may be only one or two events away from" $100-plus oil, Daniel Yergin, chairman of Cambridge Energy Research Associates, said in remarks prepared for a conference today at Georgetown University.

Mexican Crude Oil

The U.S. imported an average 1.45 million barrels of crude oil a day from Mexico during the first eight months of the year, making the country the second-biggest source of U.S. imports, according to the Energy Department.

"There are some legitimate storm fears out there but the momentum was already pushing prices higher," said Eric Wittenauer, an energy analyst at A.G. Edwards & Sons Inc. in St. Louis. "This may prove a non-event because there are forecasts that show it may move away from the Mexican fields. Until we know for sure where it is headed the storm will remain supportive."

At least 21 workers died when a rig hit an offshore platform in the Gulf of Mexico during a storm that produced waves as high as 26 feet and wind gusts of 81 miles per hour on Oct. 23. Mexican President Felipe Calderon ordered an investigation into whether the accident could have been prevented.

Gale-force winds from a weather system between Florida and the Yucatan peninsula are whipping up 8-foot waves in the Gulf of Mexico, according to the U.S. National Hurricane Center. There are no named tropical storms in the Gulf, and one near Cuba, called Noel, is expected to twist northwards and avoid the Gulf.

Lingering Nervousness

"That's pretty strong for the Gulf," said David Salmon, a forecaster at Weather Derivatives Inc. in Belton, Missouri. "It's showery and stormy over the oil production area. There's probably some nervousness lingering from the last storms they had, as well as strong winds, precipitation and eight-foot waves."

Tensions between Turkey and Iraq over Kurdish militants as well as over Iran's nuclear program have helped drive oil prices higher. Iran and Iraq hold the world's second and third-biggest crude-oil reserves, after Saudi Arabia, according to BP Plc.

"What we're seeing in the oil market today is rooted more in the cauldrons of geopolitics and the impact of financial markets, expectations and psychology than in supply and demand," said Yergin, whose book "The Prize: The Epic Quest for Oil, Money & Power," won the Pulitzer Prize.

Turkey's Warning

Turkish Prime Minister Recep Tayyip Erdogan warned Oct. 27 that his country may order wider military attacks against militant camps, if needed, according to Turkish media. Turkey said it bombed PKK units in northern Iraq last week and sent troops across the border in pursuit of the militants.

On Oct. 26, the U.S. accused Iran's military of supporting terrorism and announced new sanctions on the country. The U.S. and its allies want Iran to halt uranium enrichment that it suspects is a cover for developing nuclear weapons.

French Defense Minister Herve Morin said his government has evidence Iran is trying to build a nuclear weapon, Agence France- Presse reported today.

"There's a lot of bullish stuff out there," said Rick Mueller, an analyst with Energy Security Analysis Inc. in Wakefield, Massachusetts. "The Turks may invade northern Iraq at any time and it doesn't look like Iran and the U.S. will be getting together to sing Kumbaya anytime soon. We need to see more output from OPEC before prices retreat."

To contact the reporter on this story: Mark Shenk in New York at mshenk1@bloomberg.net. |

| |

|