|

|

|

Business News | December 2007 Business News | December 2007

Location Drives Mexican Auto Industry

Stephen Franklin & Rick Popely - Chicago Tribune Stephen Franklin & Rick Popely - Chicago Tribune

go to original

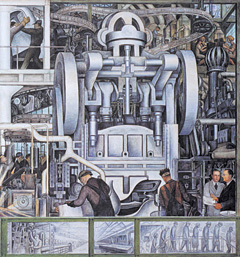

| | (Diego Rivera, 1886 - 1957) |

Puebla, Mexico - After a long, uphill climb, Mexico's auto industry sputtered and lost its drive several years ago. Then it clicked back into gear several months ago after a shaky rebound.

Will it stay in gear?

That's anyone's guess.

The doubts are largely driven by an industry tightly lashed to the uncertain state of the U.S. economy and the fate of the major U.S. auto manufacturers, whose share of the domestic auto market has been steadily eroding.

Plus, Mexico faces stiffening competition from global rivals nipping at its auto production chain.

Yet Mexican auto industry officials and auto analysts point to trends they say could both protect against shocks and provide momentum.

"If we continue with the trend that took place up until 2000, then we'll get to 3 million vehicles by 2015," predicted Ricardo Haneine, a Mexico City-based analyst for A.T. Kearny. "The industry just has to refocus," he said, on high-tech and high quality.

Mexican vehicle production reached 2 million autos annually in 2006, a 50 percent increase from 1997, and analysts say that growth is expected to continue as the major automakers churn out new models and newly arrived companies ramp up production.

General Motors Corp. will begin production in 2009 at a $600 million plant in San Luis Potosi in central Mexico that will employ around 2,000 and be capable of building around 130,000 subcompact cars annually.

Similarly, Chinese manufacturer First Automobile Works Group announced Nov. 26 that it would collaborate with Mexican business conglomerate Salinas Group to build a plant in Zinapecuaro in western Mexico. The plant is scheduled to open in 2010 and employ about 4,000.

Both plants will create additional jobs at nearby parts suppliers.

The Ford Motor Co. has not announced plans to build plants in Mexico. But Louise Goeser, president of Ford's Mexican operations told a recent industry conference the company could increase its Mexican parts purchases tenfold over the next five years to take advantage of low labor costs and proximity to U.S. factories.

Goeser did not say how much Ford will spend on Mexican parts, but she said new orders would be valued in "billions of dollars."

To be sure, the Mexican auto-parts industry expects to see a gain next year, and Bruce Belzowski, an industry expert at the University of Michigan's Transportation Research Institute, says growth in Mexico's parts industry could come from two types of suppliers: the so-called Tier 1 suppliers, such as Johnson Controls and Delphi Corp., that are following vehicle manufacturers to Mexico and smaller suppliers that are "chasing cheap labor."

Belzowski said it's more likely to be the former because among smaller suppliers, the ones that make parts for Tier 1 suppliers, "if they're going to Mexico, they're probably already there."

Tier 1 suppliers such as Johnson Controls open operations in places such as Mexico primarily because their customers, the vehicle manufacturers, want them close to their assembly plants. Johnson Control's seats and instrument panels are quickly transported a short distance for just-in-time delivery in the right color and configuration to match vehicles on customers' assembly line.

"It's a real challenge to ship parts like that long distances," Belzowski said because of their size, weight and need to be delivered in sequence.

In contrast, brake pads, connecting rods for pistons or engine bearings—the kinds of parts smaller suppliers make—can be shipped from anywhere.

The arrival of China's FAW in Mexico adds an intriguing twist because traditionally foreign-based automakers bring their longtime suppliers with them when they set up shop in North America.

"Who's going to supply them?" Belzowski wonders. "We don't know if Chinese suppliers will follow."

Chinese seek advantage

The Chinese also want to take advantage of the North American Free Trade Agreement. Under NAFTA, vehicles and parts produced in Mexico are considered domestically produced in the U.S., so that "shortens the supply chain from China" for FAW and Chinese suppliers without having to deal with U.S. wages, unions or any political fallout.

FAW has said it intends to build small cars for Mexico and Central America, but Belzowski said those plans might change.

Mexico also can more easily address quality issues, said Guy Morgan, head of North American operations for BBK Ltd. in Southfield, Mich. If there is a quality glitch in parts shipped from Asia, that can halt or curtail production for two weeks instead of a couple of days with Mexican-sourced parts.

"The cost of quality has become a significant issue," Morgan said, adding suppliers no longer see Mexico mainly as a source of cheap labor but as a permanent base where they need to lower operating costs.

"So many companies ran down to Mexico in the last 10 to 20 years chasing low wages," Morgan said. "Now they're just as concerned about costs as they are in other locations."

New players enter

Richard Leal, senior director of BBK's Mexican operations, sees Mexico's supplier industry growing as more vehicle manufacturers open or expand assembly plants in Mexico, including new players in North America.

Besides a Chinese manufacturer such as First Automobile Works, he predicted a shift of "companies from Europe" because of Mexico's North American vantage point, the easy access to the U.S. market through NAFTA and Mexico's free-trade agreements with Japan and the European Union. "It makes sense for many [manufacturers] to move to Mexico."

He estimates 80 to 90 of the largest suppliers have Mexican operations and "are building everything from high technology to low technology. They're not just stringing copper wire together into harnesses."

Pointing to plans by Toyota and Honda to boost production in Mexico and U.S. automakers' similar intentions, George Magliano, a New York-based auto industry analyst for Global Insight is upbeat on the Mexican auto industry.

"It looks good for Mexico and we tell people that it will continue to look good for Mexico." |

| |

|