|

|

|

Business News | March 2008 Business News | March 2008

Dollar Dips Against Euro Before Fed Rate Call

Agence France-Presse Agence France-Presse

go to original

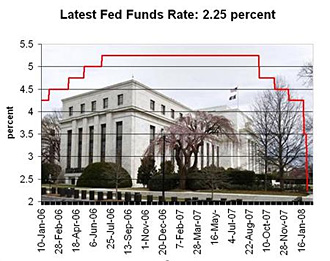

| | The Federal Reserve slashed a key U.S. interest rate by three-quarters of a percentage point on Tuesday, a substantial cut but smaller than many in financial markets had expected, as part of an effort to hold off a deep recession and financial meltdown. (Reuters) | | |

London - The dollar wobbled close to record low points against the euro on Tuesday as traders eagerly awaited an interest rate decision from the US Federal Reserve, analysts said.

The Federal Reserve was widely expected to slash its key lending rate later in the day to try to ease turmoil on Wall Street and ward off the threat of a prolonged recession in the world's largest economy.

In European foreign exchange trading, the euro advanced to 1.5813 dollars, up from 1.5725 late on Monday, when it had struck a record high value of 1.5905 dollars.

Against the Japanese currency, the dollar firmed to 97.59 yen, compared with 97.32 on Monday, when it had reached 95.75 yen which was last seen in 1995.

Investors were anticipating a bold move by the Fed to try to ease strains on the US financial system.

"There are wide views of what the Fed will do, with estimates ranging from a 50 to 125 basis points rate cut," said David Mann, currency strategist at Standard Chartered Bank.

"The dollar is still under a lot of negative pressure. The credit crisis is a US problem. It's hard to see what the Fed can do that is dollar positive," he said.

The Fed meeting follows an emergency cut by the Fed to one of its other rates on Sunday after Wall Street giant Bear Stearns fell victim to the credit crunch.

The Federal Open Market Committee (FOMC) has already slashed its key federal funds interest rate by 225 basis points to 3.00 percent since September to try to bolster the economy in the face of a US housing slump and related credit crunch.

It also lent billions of dollars to financial institutions in exchange for debt, such as the troubled mortgage-backed securities.

Investors fear that the Fed may be running out of ammunition to ease gridlock in US credit markets. Some analysts said that even a bold rate cut by the Fed later on Tuesday would not be enough to prop up ailing markets.

The market "now thinks that a rate cut alone cannot resolve the bad debt problem and stem the deterioration of the economy," said NTT Smarttrade director Takashi Kudo.

Markets were waiting nervously for earnings results from US investment banks Lehman Brothers and Goldman Sachs later on Tuesday, followed by Morgan Stanley on Wednesday, amid concern that there might yet be more victims of the credit market turmoil.

Traders were on alert for any signs that global financial authorities are considering coordinated action to try to stem the dollar's decline.

In London currency trading on Tuesday morning, the euro changed hands at 1.5813 dollars against 1.5725 late on Monday, at 154.06 yen (153.07), 0.7851 pounds (0.7872) and 1.5563 Swiss francs (1.5489).

The dollar stood at 97.59 yen (97.32) and 0.9851 Swiss francs (0.9846).

The pound was at 2.0136 dollars (1.9975).

On the London Bullion Market, the price of gold stood at 1,006.85 dollars per ounce, up from 1,011.25 dollars late on Monday. |

| |

|