|

|

|

Business News | April 2008 Business News | April 2008

When U.S. Economy Hurts, Mexico Feels It

Jane Bussey - MiamiHerald.com Jane Bussey - MiamiHerald.com

go to original

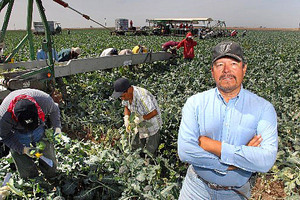

| | Francisco Chavez owns a company that uses Mexican workers to harvest broccoli in Arizona. Part of the social and economic stability in Mexico since the mid-1990s has stemmed from the 500,000 Mexicans who come to work in the United States every year, experts say. (Jacob Lopez/AP) | | |

While Mexico is the Latin American country most vulnerable to the U.S. slowdown, experts say political changes and globalization mean Mexico is more able to weather a downturn than in the past.

Finances have changed in Mexico after decades of grueling economic upheavals. But as the United States slides into an economic slowdown, the country can still not forget the words uttered by dictator Porfirio Diaz roughly a century ago: "Poor Mexico, so far from God and so close to the United States."

"Mexico is the most exposed country in the world to a U.S. slowdown," Mexican economist Rogelio Ramírez de la O said in a panel discussion on the country's economic performance held last week in Coral Gables.

Mexico's ties with the U.S. economy range from trade _ it sends 80 percent of its exports across the U.S. border _ to tourism, financial flows and providing labor.

Ramírez noted that part of the social and economic stability in the country since the mid-1990s has stemmed from the 500,000 Mexicans who come to work in the United States every year. Most of them don't have legal papers.

"If we weren't able to send these people to the United States, then the equilibrium wouldn't exist," said Ramírez, who is president of Ecanal, an economic advisory firm in Mexico City.

WAL-MART AFFECTED

Remittances are so important to household consumption that "Wal-Mart's [financial] results are highly sensitive to the variations in remittances," said Ramírez, who served as economic advisor to Mexican presidential candidate Andrés Manuel López Obrador in 2006.

"If the U.S. economy loses momentum, the impact on Mexico is very quick," agreed Juan Pedro Treviño, chief economist for HSBC Mexico.

Treviño pointed out that Mexico's industrial production tracks that of the United States, while household remittances to Mexico closely follow the path of U.S. housing starts.

HSBC has forecast the Mexican gross domestic product will grow by 1 percent to 2 percent this year and some 2 percent next year _ quite slow growth for a developing country.

But as Joydeep Mukherji, director of the sovereign ratings group at Standard and Poor's in New York, pointed out at the conference hosted by the University of Miami's Center for Hemispheric Policy, Mexico's stable economy is a change from its more problematic finances during previous downturns in the United States.

DEMAND FROM ASIA

"This time around it looks very different," Mukherji said. "Although the United States is slowing down, demand from Asia is keeping commodity prices high."

Mexico went through decades of financial crises sparked by the collapse of overvalued currencies because of current account deficits.

Mukherji praised Mexico for economic changes _ a balanced budget, locking the rules of the game in place with the North American Free Trade Agreement and more reliance on manufacturing exports instead of oil and other commodities.

The end of the one-party monopoly also has meant that political power is more evenly shared between federal and state governments and with the old ruling Institutional Revolutionary Party and the new ruling National Action Party, the rating agency executive said.

The result of all the changes is that Mexico could withstand a drop in commodity prices better than in the past.

"If the oil collapsed, it would hurt Mexico, but it would not lead to a crisis in the balance of payments," he said.

Ramírez pointed out that despite Mexico's economic stability, the adoption of an economic reform program and increased trade and investment from NAFTA, per capita economic growth has been disappointing for a quarter century.

ENTHUSIASM WANES

This slow growth and NAFTA's lost luster since the mid-1990s explains why Mexicans are less enthusiastic about policies of economic reform, the economist said.

Mexico's productive system is also tied in knots by business monopolies and powerful public-sector unions, Ramírez said. Because of monopolies or oligopolies, the price for telephone service, for example, is higher in Mexico than the United States. "If 10 prices in Mexico were brought down to 10 percent above the U.S. level, you would instantly have more competitive pricing," he said.

jbussey(at)MiamiHerald.com |

| |

|