|

|

|

Business News | June 2008 Business News | June 2008

Border Fight Over Gulf Oil Simmers Between U.S., Mexico

Marla Dickerson - Los Angeles Times Marla Dickerson - Los Angeles Times

go to original

|

Click image to enlarge | | | |

U.S. Gulf of Mexico — Eight miles north of the maritime border with Mexico, in waters a mile and a half deep, Shell Oil Co. is constructing the most ambitious offshore oil platform ever attempted in the Gulf of Mexico.

As tall as the Eiffel Tower, the floating production facility will be anchored to the ocean floor by moorings, spanning an area the size of downtown Houston.

Slated to begin operating late next year, this leviathan known as Perdido (or "lost") will cost billions and be capable of pumping 100,000 barrels of crude a day.

But Perdido's most notable achievement might be to compel Mexico to loosen its 70-year government monopoly on the petroleum sector, thanks to a phenomenon that Mexicans have dubbed the "drinking-straw effect."

Mexicans fear that companies drilling in U.S. waters close to the border will suck Mexican crude into their wells. Actor Daniel Day-Lewis' fictional oilman in "There Will Be Blood" compared the concept to siphoning a rival's milkshake.

"When they take petroleum from the American side, our petroleum is going to migrate," Francisco Labastida Ochoa, head of the Mexican Senate's Energy Committee, told the newspaper Milenio recently.

In Mexico, oil isn't merely a commodity — it's a symbol of national sovereignty. Rancor over foreigners — namely America's Standard Oil — profiting from its hydrocarbons led Mexico to nationalize its industry in 1938. The state-owned oil company Petróleos Mexicanos, or Pemex, is forbidden by law from partnering with outsiders to exploit a drop of Mexican crude.

But for a growing chorus of Mexicans, sharing a milkshake is preferable to watching your neighbor drink it up. Mexico has no viable deep-

water drilling program to match U.S. efforts near the maritime border, and it lacks ironclad legal means to defend its patrimony. Some Mexicans are urging their government to partner with the U.S. to co-develop border fields or risk losing those deposits.

Mexican Energy Secretary Georgina Kessel has spoken repeatedly about her desire to negotiate such a pact. Cross-border fields are a hot topic in Mexico's Congress. Lawmakers are embroiled in heated debate on how to strengthen Pemex, which provides 40 percent of Mexico's tax revenue but whose slumping output is alarming officials.

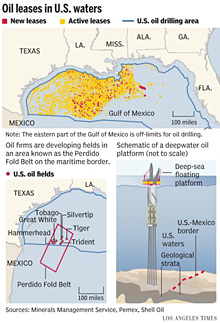

Proposed legislation still would ban partnerships. But consensus is growing to permit some exception in the Gulf region as oil companies move closer to Mexican territory. The U.S. has issued drilling rights on dozens of parcels less than 10 miles from Mexican waters. Shell, BP America Inc., Chevron Corp. and Exxon Mobil Corp., plus independents including Houston's Bois d'Arc Energy Inc., have secured acreage adjacent to the boundary.

It's unclear whether big shared deposits even exist in the Gulf of Mexico. Historically, the region's deep-water finds have been isolated pockets of petroleum, not large fields.

Officials at the U.S. Minerals Management Service, the federal agency that regulates U.S. offshore production, said they had no knowledge that any Gulf reservoirs now under development crossed the international divide. Shell, which is developing its Perdido platform with Chevron and BP, said the deposits they were targeting were confined to U.S. territory.

Mexicans are skeptical. A recent editorial cartoon showed a greedy Uncle Sam sucking from a straw plunged deep into the Gulf. But Pemex hasn't done the seismic and drilling work needed to determine if there is crude on its side.

All the more reason for Mexico to collaborate with the U.S. and find out what lies near the 470-nautical-mile Gulf border, Mexico City attorney and maritime law expert David Enriquez said.

A spokesman for Minerals Management Service said his agency had worked with Mexico before on boundary issues and was open to discussing cross-border fields. "It's the neighborly thing to do," said Dave Cooke, deputy regional supervisor for resource evaluation for the agency in New Orleans.

Oil and gas fields straddle many international borders. Countries typically come to so-called unitization agreements, in which they share the costs to extract deposits and split proceeds based on how much lies in each nation.

Britain has partnered with the Netherlands and Norway in the crowded North Sea. Australia and East Timor have a unitization agreement, as do Nigeria and Equatorial Guinea.

But the U.S. and Mexico have long skirted the topic, given their prickly history over oil.

Until recently, such an agreement wasn't necessary. Both nations had plenty of shallow-water reserves to keep them occupied. Low oil prices did not justify the exorbitant costs of deep-water drilling, where a single well can cost $100 million or more.

But exploding crude prices and advances in seismic technology have oil companies pushing into the farthest reaches of the U.S. Gulf. Private operators snapped up a record $3.7 billion worth of leases at Mineral Management Services' March auction, virtually all of them in deep water.

Since 1992, oil companies have drilled more than 2,100 wells at depths greater than 1,000 feet in the U.S. gulf. Pemex has drilled seven deep-water wells since 2004. None is producing petroleum and probably won't for years.

Therein lies the nation's predicament. Mexico is the world's sixth-largest crude producer, but production is in its fourth straight year of decline. Mexico could become a net oil importer within a decade if it doesn't find new reserves fast.

Cantarell, a shallow-water Gulf field in southern Mexico, is drying up. April output averaged just more than 1 million barrels a day, less than half of its peak in December 2003.

Pemex says there are billions of untapped barrels in Mexico's deep waters. But it lacks the capital and know-how to go after them.

A bill being pushed by President Felipe Calderón's administration would make it easier for Pemex to hire the expertise it needs. But deep-water projects cost billions and can take a decade to come on line. Oil majors typically want a share of any crude that they find — a standard industry practice forbidden by Mexico's constitution.

It's unclear whether a constitutional change would be necessary to let Mexico forge a unitization agreement with the United States. Industry experts said a deal would make sense for both sides.

Companies working in U.S. waters would not have to worry about Mexico taking legal action if it were determined that Mexican crude was ending up in their wells. International law and commercial custom dictate that communal reservoirs be shared. But the U.S. has not ratified a key United Nations treaty on maritime law, which could complicate Mexico's effort to pursue any complaint over pilfered crude.

Nevertheless, oil companies do not like surprises, said Michelle Foss, chief energy economist at the University of Texas' Bureau of Economic Geology. "You're not going to put a billion dollars at risk if ... you might have to suspend operations because of an international dispute," she said.

A unitization deal would give Pemex a chance to learn from deep-water veterans who have been working the Gulf for decades. There is pipeline infrastructure on the U.S. side, eliminating the need for Mexico to duplicate the costly effort.

Critics such as Mexican opposition leader Andrés Manuel López Obrador claim border fields are the first step in opening Mexico's energy sector to foreigners and privatizing Pemex. Calderón denies it.

As Mexico mulls its next move, the U.S. is exploring gas. Its Gulf crude production averages 1.3 million barrels daily and is projected to rise to as much as 2.1 million barrels a day by 2016, thanks to Perdido and other deep-water projects.

Shaped like a giant tin can, Perdido will be anchored in 8,000 feet of water, making it the deepest so-called spar in the world. The movable structure, with as many as 150 workers, will tap oil at three fields: Silvertip, Tobago and Great White.

"The easy oil is gone," said Russ Ford, Shell's technical vice president for the Americas. |

| |

|