|  |  |  Business News | January 2009 Business News | January 2009

Mexico Tycoon Slim Eyes More Bargain Investments

Tomas Sarmiento & Noel Randewich - Reuters Tomas Sarmiento & Noel Randewich - Reuters

go to original

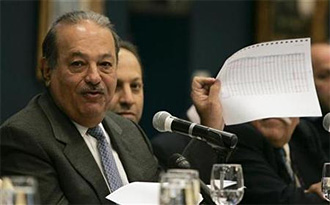

| | Mexican billionaire Carlos Slim speaks during an interview with foreign correspondents in Mexico City September 30, 2008. (Reuters/Felipe Courzo) |  |

Mexico City - Mexican billionaire Carlos Slim, the world's second wealthiest man, is eyeing more investments in companies hard hit by the global credit debacle, his spokesman said on Thursday.

Slim's $250 million investment in The New York Times Co(NYT.N), announced this week, as well as the recent purchase of a stake in Citigroup (C.N), suggest that the former stock trader has been unable to resist bargains created by the market meltdown.

Arturo Elias Ayub, Slim's spokesman and son-in-law, told reporters that market turmoil and the economic downturn continue to create investment opportunities.

"We're looking at the possibility of investing in whatever makes financial sense," he said. "Some things look attractive."

Slim, worth $60 billion last year, according to Forbes magazine, revealed in November he had taken an 18 percent stake in Saks Inc (SKS.N), prompting the luxury retailer's board to take steps to head off a takeover.

Shares of Saks have buckled in the past several months as the credit crunch and slumping U.S. economy force even well-heeled shoppers to cut spending.

The New York Times Co, which owns the namesake newspaper as well as The Boston Globe and other local U.S. papers, is struggling to pay off more than $1.1 billion in debt in the next few years, even as advertising revenue deteriorates.

The publisher's shares have slumped 60 percent over the past 12 months.

Amid the global financial crisis in November, Slim's Inbursa (GFINBURO.MX) bank acquired a $150 million stake in Citigroup as Wall Street investors dumped the stock, sending it to a 16-year low.

The son of a Lebanese immigrant who made a small fortune by acquiring property during the 1910-1917 Mexican Revolution, Slim's trademark in Mexico is his "Midas" business touch, buying struggling companies on the cheap and turning them into profitable cash cows.

(Editing by Carol Bishopric) |

|

|  |