|  |  |  Business News | July 2009 Business News | July 2009

U.S. Migrant Money Pools Thrive in the Recession

Tim Gaynor - Reuters Tim Gaynor - Reuters

go to original

July 01, 2009

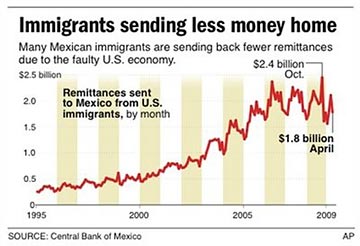

| | Remittances by Mexican workers to their families in the country fell 19.87 percent in May to $1.9 billion compared with the same month in 2008. |  |

Tempe, Arizona - A year ago, waitress Erica Rendon was invited by a Mexican colleague at the steakhouse where she works to put $50 a week into a fund with nine co-workers.

Every eleventh week her number comes around and she gets a $500 windfall which she has used to pay off $1,600 in credit card debt and take her mother out to dinner on Mother's Day.

"It's a nice little savings account. I've asked the woman who coordinates never to tell me when my number comes up so that all of a sudden on a Friday evening, surprise! Surprise! I've got $500!," said Rendon.

Little known outside migrant communities, these funds are known as "cundinas" or "tandas" in Mexico and Central America.

Similar associations, known as "susu" in West Africa and the Caribbean and "hui" in China and parts of Asia, are also common in U.S. migrant communities.

Now as the recession shrivels up credit and makes consumers wary of racking up debts, these small savings and credit associations are thriving.

Since these clubs help people spend money, they can act like mini, private stimulus packages for local economies. They also encourage financial discipline and credit-worthiness - two attributes that come in handy in real loan applications.

"They are a worldwide phenomenon for poor people whose access to capital is limited ... The easiest way to do it is to pool your resources," said Carlos G. Velez-Ibanez, an anthropologist at Arizona State University.

"There's an increase in (their) use right now. It's harder and harder to get money from formal institutions, so middle class people ... are accessing these tandas and cundinas to make up the shortfall."

BY INVITATION ONLY

The tandas often operate in work places and many are run by women. Participation is by invitation.

Typically a group of 10 to 20 members put away anywhere from $50 to $100 at an agreed interval of one or two weeks, and receive a payout when the fund comes round full circle, or beforehand, as an interest-free loan.

"Nobody makes money and nobody loses. It's like we're playing around with the money for people who need it," said Evelyn Alvarado, 23, a nonprofit worker in Los Angeles who pays $100 a week into a 12-member cundina.

Past payouts helped her take a trip to Guatemala, buy Christmas gifts and make car payments. Sharing responsibility among the group encourages her to keep up with her contributions, she said.

Across the country in Paterson, New Jersey, Anthony Davis, 44, a councilman and college administrator of Trinidadian descent, has taken part in a susu for the past nine years. He used the latest $1,200 payout to settle a credit card bill.

"But this payoff ... I can save, because I'm pretty much okay with the bills," said Davis.

In San Francisco, Mexican small business trainer Susana Gama, 50, paid $50 every two weeks into a tanda with 11 other co-workers. She put the $600 payout into her retirement fund.

"We just started a second one, and the money I get from that I will use toward a deposit to buy a home," she said.

The funds have largely operated apart from the mainstream financial system. But at a time when easy lending and reckless borrowing brought that system to the brink, banks and financial institutions are beginning to recognize participants' patient, disciplined commitment.

The Mission Asset Fund, a San Francisco-based nonprofit working with low income residents to build a more secure economic future, recently developed a program to help tanda members, among them Gama, use their contributions to build a credit history.

Over four months, participants' average credit scores improved by 52 points.

"A credit score is nothing more than a record of people's payments ... We're saying this is bona fide financial activity that should be recorded, but it's not," said Jose Quinonez, executive director of the Mission Asset Fund.

One local community bank working with the program recognizes the merit of the tanda model.

"It really does hit on the fundamental of lending. Is the person you are lending money to someone you can trust? Someone who is honorable, someone who you think will pay you back?" said Jeffrey Cheung, president and CEO of OneCalifornia Bank.

"Is it a basic lesson that bankers could all take a look at right now? Yes."

(Additional reporting by Laura Isensee in Los Angeles; Editing by Alan Elsner and Mary Milliken) |

|

|  |