|  |  |  Americas & Beyond Americas & Beyond

Americans See Children's Future Dim in Poll as 50% Pessimistic

Rich Miller - Bloomberg Rich Miller - Bloomberg

go to original

October 13, 2010

| | Americans say they have weathered the worst of the longest recession in seven decades, even as they are pessimistic about prospects for their retirement years. |  |

Americans say they have weathered the worst of the longest recession in seven decades, even as they are pessimistic about prospects for their retirement years, according to a Bloomberg National Poll.

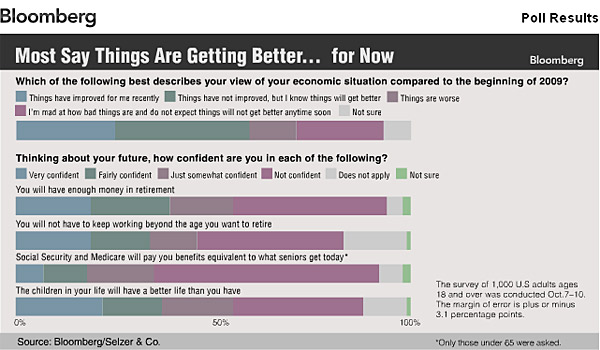

Three in five respondents to the Oct. 7-10 poll say their economic condition has improved recently or they are confident it will get better. One in three say things have gotten worse or aren’t likely to improve anytime soon.

“I see some hope, but not a lot,” says poll respondent Brian Ridlon, 34, an out-of-work resident of Green Mountain, Arkansas, who wants to learn how to become a barber. “There are some avenues to improve yourself, but we need more.”

What optimism there is about the immediate future doesn’t carry over to the longer term. Pluralities of those polled say they’re not hopeful they will have enough money in retirement and expect they will have to keep working to make up the difference. More than 50 percent aren’t confident or are just somewhat confident their children will have better lives than they have.

“I don’t think they’ve got a chance,” says Brian Rich, a 65-year-old retiree with three children in their 20s who lives in Gloucester, Massachusetts. “I’m very angry at what’s going on in this country. Change is being forced upon us.”

A year after the official end of the recession, economic growth has slowed, slipping to a 1.7 percent annual pace in the second quarter from 3.7 percent in the first and 5 percent in the final three months of 2009. Unemployment stood at 9.6 percent in September, down from a 26-year high of 10.1 percent in October 2009 while still above the 5 percent rate that prevailed at the start of the recession almost three years ago.

Long-Term Pain

“The worst is behind us, but the pain will be felt for a long time,” Warren Buffett, the billionaire chairman of Omaha, Nebraska-based Berkshire Hathaway Inc., said in recorded comments released yesterday at a conference in Israel. “We’re inching forward, we’re not galloping forward.”

Americans are responding to the tough times by conserving cash and making do with less over the past couple of years, according to the poll.

Almost half say they’ve started using coupons and changed where they shop for groceries and other household items to save money. Forty-four percent have cut regular household expenses, such as cable television, telephone or Internet service. Fifty- four percent have put off a major needed purchase, such as a car, started doing some chores or home repairs on their own, or figured out ways to drive less. In all, 85 percent say they have taken some step to cut costs.

Blaming Wall Street

Wall Street financial firms and the mortgage industry get the most blame for the country’s economic weakness. More than three-quarters of the 1,000 Americans polled say the former has hurt the economy, while more than 80 percent fault the latter. Former President George W. Bush also comes in for criticism, with three times as many people saying he hurt the economy as those who believe he helped it.

Americans are more ambivalent about the roles that President Barack Obama and Federal Reserve Chairman Ben S. Bernanke have played, with those surveyed about evenly split between whether the two men have helped or hurt the economy.

Treasury Secretary Timothy Geithner comes off worse, with 34 percent saying he’s had a negative effect on the economy versus 20 percent who say his impact was positive. The rest of the respondents aren’t sure.

Poll respondents disapprove of the government’s Troubled Asset Relief Program, or TARP, which was used to provide financial help to banks and automobile companies. Pluralities of more than 40 percent of those surveyed say TARP will weaken the economy rather than strengthen it.

Angry at Bailouts

“TARP has come to be short-hand for bailouts, and while people struggle to pay their mortgages, buy groceries and hold onto their jobs, bailouts make people mad,” says J. Ann Selzer, president of Des Moines, Iowa-based Selzer & Co., which conducted the poll. “They do not see those bailouts leading to jobs, as they do the stimulus programs.”

Geithner argues that the TARP program, in which the government committed more than $500 billion at its peak, deserves credit for helping avert an economic collapse and that it probably will end up costing taxpayers less than $50 billion.

Americans are more favorably inclined to the $814 billion stimulus package that Obama and congressional Democrats pushed through in 2009. Some 43 percent say it will lead to a stronger economy, versus 26 percent who see it weakening growth.

Small-Business Aid

Separate legislation that Obama signed in September to help small businesses with tax breaks and access to credit received even higher marks in the poll. More than 60 percent say it will strengthen the economy; less than 15 percent think the opposite.

Still, the stimulus spending, coupled with the loss of tax revenue from the recession, has helped expand the federal government’s budget deficit.

That’s got Americans worried. More than half of those contacted describe the deficit as dangerously out of control and a threat to the economic future of the U.S. Less than 5 percent think it will cause no lasting harm.

“How much waste and fraud is going on makes you sick,” says Joe Strelnik, a 55-year-old retiree in Euclid, Ohio. “Our children and our grandchildren are going to be paying for it.”

The shortfall between spending and revenue was $1.29 trillion in the year that ended Sept. 30, down from $1.42 trillion the previous year, according to the Congressional Budget Office. At 8.9 percent of the nation’s gross domestic product, the 2010 deficit was the second biggest since 1945.

Burden on Rich

Americans overwhelmingly want the wealthy to carry more of the burden of putting the government’s fiscal house in order. Sixty-five percent say lawmakers should consider raising taxes on the rich back to where they were 10 years ago.

They also want to consider measures that would fall more broadly on all Americans such as cuts in spending on roads, bridges and public transport, curtailment of extended unemployment benefits and reduced subsidies for college loans.

Almost three in five say privatization of the Medicare program, with assistance for low-income seniors, should be considered when lawmakers discuss how to close the budget gap. A majority, though, oppose raising the age at which people can start receiving Medicare benefits.

Americans are narrowly against lawmakers considering Social Security privatization as a means to reduce the deficit. Forty-eight percent say that should be off the table versus 44 percent who want the possibility looked at. Almost three in four favor lawmakers studying removal of the Social Security tax cap so wages over $107,000 a year are taxable.

More than 55 percent of those surveyed under the age of 65 say they aren’t confident they’ll get the same benefits from Social Security and Medicare that seniors are getting today.

“I have no confidence in Social Security,” says Mark Moreth, 47, a resident of Orange, California, who is out of work after breaking his back earlier in the year. “All the years I’m putting money into they’re spending it for other things.”

The poll of 1,000 adults has a margin of error of plus or minus 3.1 percentage points.

To contact the reporter on this story: Rich Miller in Washington rmiller28(at)bloomberg.net

To contact the editor responsible for this story: Mark Silva Msilva34(at)bloomberg.net

|

|

|  |