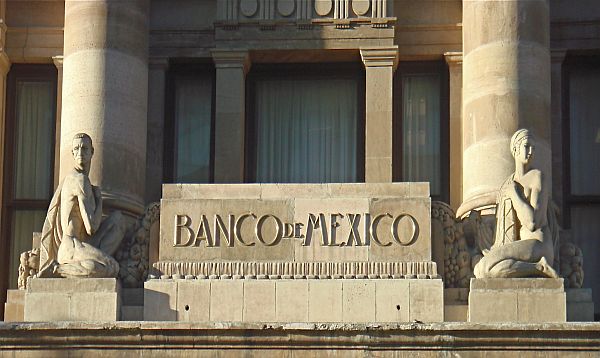

Following a number of statements by other central banks regarding the dangers of digital currencies, the Bank of Mexico has issued its first statement on the issue.

The bank warned the public via a statement on its website about "the inherent risks of acquiring these assets and using them as substitutes for conventional methods of payment," though most notable were potential restrictions for domestic financial institutions, reports say.

Translations of the statements suggest that financial institutions regulated in Mexico "are not authorized to use or carry out any operations with digital currencies."

Specifically mentioning bitcoin and litecoin, digital currencies, the bank said, "are not legal tender currency in Mexico, since the Bank of Mexico does not issue nor back them." Furthermore, "their use as a form of payment is not guaranteed, since businesses and anyone else are not required to accept them."

Like other central bank warnings, the bank felt it necessary to warn users of the perceived links between digital currencies and crime, saying, "in other jurisdictions, they have been allegedly used in illicit operations, including fraud and money laundering."

Bank Restrictions

|

"My understanding," he said, "is that the announcement from the Bank of Mexico is very similar to that made by other countries – in essence consisting of a warning to the public, and a restriction on financial institutions from dealing directly in Bitcoin."

"After consultation with our legal council, we do not believe this impacts on our business directly, nor would it in principle have any effect on banking relationships with bitcoin-related companies," stated Peters

Regulation Rumors

Pablo Gonzalez, CEO of Bitso agreed that the statement is nothing to worry about just yet. "This is the first announcement from the Bank of Mexico regarding bitcoin or other cryptocurrencies," he said. "They are warning the public that the use and acquisition (of digital currencies) can have a high risk of depreciation and monetary losses."

However, the bank’s wording might hint at things to come regarding cryptocurrencies and regulation. Gonzalez points out that: "They state that the Bank of Mexico, along with other authorities in Mexico, will closely observe their development and infiltration in the country, and, if deemed necessary, they will look into regulating these virtual assets."

Global Impact

In recent months, there have been a host of similar warnings from central banks around the world, with some recent examples being Cyprus, the Philippines, and Hungary. The statements from Mexico, while negative, could eventually give way to an understanding.

For example, Russia seemed to have banned bitcoin, only to backtrack, saying it was merely investigating how best to deal with digital currencies and avoid their use in crime. Most recently, the US seemed to be reversing its negative stance, as New York has indicated it will have regulation in place for bitcoin exchanges by the 2nd quarter of 2014.

Original Story