|

|

|

Vallarta Living | Home & Real Estate | March 2005 Vallarta Living | Home & Real Estate | March 2005

Retirees Find Value, Sun in Mexico

Sally Stich - The Denver Post Sally Stich - The Denver Post

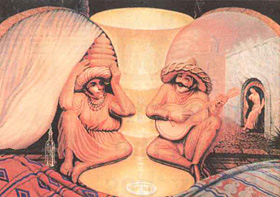

| | The Mexican-born contemporary artist Octavio Ocampo's work "Forever Always." The old couple's youth is reflected in the two human bodies hidden in the faces. Ocampo says the woman is always young and beautiful in the man's mind. But, is that also a chalice of youth in the centre of the picture? |

Retiring to Mexico has never looked better, thanks to a change in the tax laws that allows foreigners to own property.

One Colorado company is developing homes near La Paz for American retirees, and other residents nearing retirement say that by crossing the border they can stretch their dollars.

"Mexico is this generation's Florida," said Pam Dumonceau, a financial adviser and owner of Consistent Values Inc. in Aurora. "Not only is the climate ideal, but you can get beachfront property in some areas at a fraction of what it would cost in desirable retirement locations like Florida or California."

Dumonceau has been suggesting retirement in Mexico - or elsewhere abroad - to many of her clients for the past five years.

"There are two phases to retirement," she said, "early, when your health is still good, and late, when it starts to decline. Almost 95 percent of Americans retire with debt, so if they can reduce expenses and save in the early phase, they should be OK in the later phase," she said.

Since housing is often the biggest expense in retirement, the key is to reduce housing costs while maintaining a high quality of life.

A couple who retire on $60,000 a year after taxes can afford a home in Mexico and a modest condo in the States for family visits, she said. Their $5,000 a month could stretch a lot farther if their primary residence is in Mexico.

"It never crossed our minds to live in Mexico during retirement," said Phil Allen, 56, a semiretired Denver business development consultant. But last year, when he and his wife, Trish, were introduced to the still-in-progress development Paraiso del Mar in La Paz, they fell in love with the promise of a lifestyle that mixes beautiful scenery with a balmy climate and outdoor recreation.

It doesn't hurt that their 2,150-square-foot home, still being built, already has appreciated. "Prices of homes in this development have gone up 10 (percent) to 20 percent since we bought," Allen said.

The process has been expedited by sweeping reforms in Mexico's judicial and foreign investment system. Foreclosure laws were strengthened two years ago, which has led more U.S. financial institutions to lend money for Mexican real estate. Although Mexico's Constitution prohibits direct ownership of real estate by foreigners along the country's borders and coastlines, a new real estate trust has been created. A Mexican bank holds the property's title on behalf of the foreign buyer.

"It's much easier now for Americans to get mortgage financing for homes in Mexico," said developer John Fair, whose company Fair Enterprises is developing Paraiso del Mar.

Developers like Fair also offer traditional construction financing packages, get title insurance "and we help get the trust lined up, since the title is in the form of a trust with a Mexican bank as the trustee," Fair said.

It's still not the same as buying a home in the U.S. "There's more paperwork, which takes more time to process than here," Fair said, "and closing costs will run between 3 (percent) and 6 percent."

Retirees Lowell and Kathy Williams consider their 1989 purchase of a condo in San Jose del Cabo a great preretirement move. One hundred yards from the Sea of Cortez, they enjoy a climate much like Southern California, their last residence before retirement.

"Beachfront property in Southern California was well out of our financial range," said Kathy, 51, a former regional manager for Pacific Bell. In Mexico, the couple enjoy a lifestyle not far removed from the life they dreamed about in Los Angeles.

Lowell loves fishing. He and Kathy enjoy exploring the mountain trails on ATVs. They also admit that, at least where they live, the price of housing is far from reasonable.

"We paid $300,000 for our condo in 1989. Today, new condos on the same stretch of beach are going for closer to a million," Kathy said.

Farther north at Paraiso del Mar, Fair's development offers 5 miles of beachfront at about a third of what a similar place in Cabo San Lucas costs. Buyers can enjoy a gated community that will eventually include 2,000 condos, 1,500 single-family homes and 1,500 rooms in five hotels. The homes will range from $200,000 to $600,000. The development will offer churches, tennis courts, golf courses, country clubs and an extensive system of nature trails for pedestrians and cyclists. The south shore's mangrove ecosystem will remain intact, and 1,000 acres have been set aside for wildlife sanctuaries and open space.

"The cost of living in La Paz is simply lower than in Cabo," Fair said. "You can hire a full-time maid in La Paz for $300-400 a month. Food is fairly reasonable. You can live as if you were upper middle class in America but on much less money."

Another popular development is farther north, just 700 miles south of San Diego. The Villages of Loreto Bay will be built over 15 years and will create a town of approximately 6,000 homes in pedestrian-oriented, car-free neighborhoods. Homes start in the mid-$200,000s.

Still, retiring in Mexico raises certain predictable issues. "I hear people raise two concerns," Dumonceau said. "The first is they don't want to be far from their grandkids. The second is a concern over health care."

Kathy Williams calls the grandkid issue a no-brainer. "It's easy to fly back to the States to get a grandkid fix," she said.

Health-care concerns appear to be less an issue than in years past, although it depends on where you choose to live.

The Williamses say it's easy to find a good doctor in their town. The real problem is a lack of equipment and facilities. They solved it by buying an insurance policy that covers their costs if they need to be airlifted to the States for medical care.

For routine care, Kathy Williams uses a local doctor who has a small boutique hospital where she spent three days several years ago with pneumonia.

"I had 24-hour on-premise doctors and nurses, fresh flowers in my room every day, and food from local restaurants - whatever I wanted," she said.

Trish and Phil Allen haven't tested the medical care yet, but they aren't terribly concerned.

"There are two world-class hospitals in La Paz," Phil said, "but if we hike and swim, eat lots of fresh fruits and vegetables - as we plan to do - we don't think we'll need much medical attention." |

| |

|