|

|

|

Puerto Vallarta Real Estate | September 2007 Puerto Vallarta Real Estate | September 2007

US Real Estate Woes Make Their Way to Mexico

Marla Dickerson - Los Angeles Times Marla Dickerson - Los Angeles Times

go to original

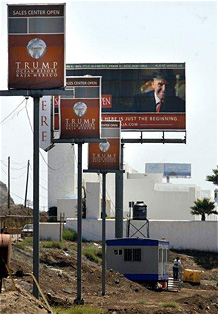

| | Interest in the Trump Ocean Resort Baja is strong, according to a project spokesman who said a June sales event yielded $45 million in contracts in just five hours. Still, some Baja real estate veterans worry that other projects will fold. (Los Angeles Times) |

Playas De Rosarito, Mexico – The ripples of the U.S. real estate boom began washing up on the shores of this beach town a few years ago. Californians, feeling flush from the steep run-up in housing values stateside, pulled equity from their primary homes and snapped up vacation properties in northern Baja California as if they were buying $10 lobster dinners.

Ground zero was this mid-sized community about 20 miles south of Tijuana, where developers sold hundreds of condominiums on spec. Most jacked up their prices as their projects filled, fueling a sense of urgency among U.S. buyers to get in while the getting was good.

"We nearly had... fistfights" over choice units, said Michael Coskey, sales director of the Residences at Playa Blanca, a 274-unit development under construction north of Rosarito whose average condo is priced at $500,000. "We were all appealing to people's greed."

Greed has turned to regret for some investors who now can't sell their Mexican properties.

Upward of 40 percent of the condos in some northern Baja projects were purchased by flippers who intended to resell them even before construction was finished. Their aim was to pocket a fast profit in an area where prices had been appreciating 20 percent to 30 percent annually in recent years.

But with contagion from the U.S. subprime mortgage debacle spooking many would-be purchasers and credit drying up, the Baja real estate market is flagging. Speculators are starting to sweat.

Californian Chris Romero's biggest worry two years ago was missing out on the action. He had his eye on a $200,000, two-bedroom condo in a project called La Jolla Real in Rosarito.

But by the time the then-Diamond Bar, Calif., resident was ready to commit, the developer had raised the pre-construction price to $250,000.

Instead of folding, Romero doubled down, handing over a $120,000 down payment to lock up two units – one for $238,000, the other for $270,000 – before prices increased again. The retiree and his wife reckoned they would sell the less expensive one just before closing and use those profits to help finance the other.

"The market was booming," said Romero, 60.

No more. With the development nearing completion, he's finding buyers scarce and competition fierce. Rosarito is littered with so-called "resale" units whose owners are looking to unload them. Romero is offering a $5,000 bonus to anyone who can bring him a buyer. His $290,000 asking price is "negotiable." And he's willing to provide financing.

More inventory is on the way. About 7,000 condominiums are in the pipeline from Tijuana to Ensenada, with another 5,600 in the planning stages, according to the Association of Resort Developers of Baja California. The average price is about $300,000, but some luxury units run into the millions.

Developers say that's still a bargain compared with oceanfront property in the U.S. Still, some people say prices here soared more quickly than was rational in an area known for budget motels and cut-rate seafood.

"Everybody was going for the $500,000 condo, the Bellagio," developer Ramon Toledo Arnaiz said. "The fuel was from speculators."

Flippers who can't find buyers will have to come up with the cash to honor their contracts or secure Mexican mortgage financing at rates as high as 12 percent.

Those who can't close the deals risk forfeiting their down payment, often 30 percent of the purchase price.

"The ones who bought multiple units are going to be in real deep doo-doo," said real estate agent Roberta Giesea, owner of Baja4U Properties. "The market has slowed way down."

Speculators likewise are smarting in Puerto Pen asco, also known as Rocky Point, a beach resort in Sonora state 60 miles south of the Arizona border on the Sea of Cortez.

Egged on by soaring real estate prices at home, Arizonans snatched up Puerto Pen asco condos at "crazy" prices that topped $1 million for some penthouses, according to Dee Brooks, owner of Twin Dolphins Real Estate in Rocky Point.

She said many flippers haven't been able to sell their units. Meanwhile, the rental market is so saturated that most can't cover their costs by leasing their properties.

With the Arizona market cooling, some investors don't have enough equity remaining in their U.S. homes to close on their Mexican condos, nor can they get financing in a tightening credit market.

Brooks said she had dozens of listings from "desperate" sellers, some of whom might have to walk away from their properties if they can't find buyers to bail them out. She figures prices on some units will have to fall at least 25 percent for her to move them. Owners are in denial.

"They call me up crying, but what can I do?" Brooks said. "I can't perform a miracle. The market is slow. I'm not going to be able to get them the money they want."

It's not just buyers who got caught up in the frenzy. Some northern Baja developers paid top dollar for oceanfront lots where they built luxury homes with million-dollar-plus prices. Some of those houses are languishing unsold, according to real estate agent Kerry Kay Sims, president of Baja Relocation.

"The real estate market in California was so strong and so crazy that it was like they were stoned on it," Sims said. "The thinking was that somebody will pay no matter how high the price is.... Conditions have changed."

You wouldn't know it from motoring along the coastal toll-road than connects Tijuana with Rosarito.

Billboards in English beckon prospective homebuyers to purchase a slice of the good life. Flags flutter in the sand at oceanfront real estate sales offices. Clanking cranes and roaring earth-movers are busy clearing new building sites.

Indeed, concern is rising among some Baja real estate veterans that some undercapitalized projects might fold – taking purchasers' deposit money with them and scaring off future investors.

Independent agent Brian Flock said several condo developments were behind schedule, owners at others were having trouble getting their titles and buyers in some developments were being hit with unexpected charges.

"It's just obvious that some (developers) are desperate for cash," Flock said. "My biggest concern is that the unsound developments will damage the whole market."

After four futile months of marketing her condo, Judy Dinnel just wants out. She and her husband planned to flip a two-bedroom unit in a project called Riviera de Rosarito that they bought last year during pre-construction for $330,000.

At their $369,000 asking price, the Avila Beach, Calif., couple would barely break even, after paying commissions plus a $10,000 bonus they're offering agents to move the unit.

It won't be easy. More than 40 percent of the project's condos are back on the market, according to the listings on the development's Web site.

To protect their $100,000 down payment, the Dinnels are considering taking an 11 percent loan from the developer until they can find a buyer. Those payments will run $3,300 a month – more than double the monthly payment on their California residence.

"We will be strapped," said Dinnel, 51. "We'll have to cut back on everything... I'm losing sleep." |

| |

|