Puerto Vallarta, Mexico - On July 4, 2014, the Secretary of Hacienda and Public Credit, the Mexican version of the IRS or Revenue Canada, issued a miscellaneous fiscal resolution that as of September 1, 2014 will affect all buyer and sellers of real estate in Mexico, regardless of their nationality.

|

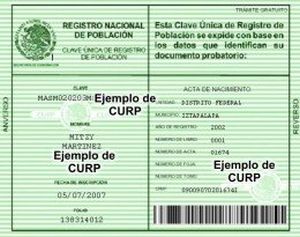

Furthermore, since it is the notary public that will issue the tax-deductible electronic receipt (CFDI or Comprobante Fiscal Digital a través de Internet), the current criteria of the local notaries here so far is to insist on having both buyer AND seller show proof of the CURP and RFC in order to fully complete the receipt or CFDI.

|

If you happen to be a foreign national, you will need to have either a permanent or temporary residency card as well, as right now it is a precursor to obtaining the CURP. (In practice those with a tourist visa are not being allowed to request a CURP).

Those who do not have the residency permit must apply for the card at the nearest Mexican Consulate in the country of your origin and it should not take more than a few days. The card that you are issued should show the CURP. Once you have your CURP, you can apply for your RFC online. I would strongly recommend having a local accountant help you in order to make sure that the information you are providing is correct. He/she can walk you through the process and coordinate the appointment to finalize the procedure.

Although these procedures can be done online, you will eventually have to be present in Puerto Vallarta to register your residency permit with the local immigration office and to pick up the proof of your RFC at the local office of the tax authority (SAT) so when planning your closing dates I would also allow for time to have these things completed.

You will be shocked at how competent, professional and service-oriented the Mexican tax authority is - it is a unique experience when compared to some of the red tape procedures the US government puts you through. Your residency and tax ID number will give you an identity in Mexico and will make certain procedures more streamlined and efficient. I have also heard that the procedures at the individual consulates are also well-organized and hassle-free.

This new regulation just passed a couple of weeks ago and as with any new law, we expect that there could be changes as it is gradually implemented. The reasoning behind this is to ensure fiscal transparency in all purchase sale operations for everyone - both national and foreigner alike. I will keep you informed of any subsequent modifications in these regulations.

We just received this note from one of our American clients who just applied and received his RFC:

"It was way easier than I thought it would be, I just got a confirmation number online, then we went down to SAT, gave them our ID's and in 5 minutes we had our numbers. Didn't have to go back online and register or anything. That's the fastest and easiest thing I've ever had to do in Mexico."

Maria O'Connor is the In-House Legal Council for Tropicasa Realty. As an attorney specializing in real estate transactions, María has been at the forefront of the Puerto Vallarta legal community for many years, providing an important service for foreign and Mexican real estate clients alike. Contact her at maria(at)tropicasa.com Since 1997, Wayne Franklin and his team at Tropicasa Realty have been a trusted name in Puerto Vallarta real estate. Tropicasa Realty is the region's representative for "The Leading Agents of the World" and with over 100 years of combined experience in real estate, all agents of the company are affiliated with AMPI. Wayne Franklin or any member of his knowledgeable team can be contacted in-person at their Romantic Zone Office - Pulpito 145-A at Olas Altas or in their San Marino Office - San Marino Hotel at Rodolfo Gomez 111-4. While in PV they can be reached at (322) 222-6505 or by calling 866-978-5539 (Toll-Free) from the U.S.

Since 1997, Wayne Franklin and his team at Tropicasa Realty have been a trusted name in Puerto Vallarta real estate. Tropicasa Realty is the region's representative for "The Leading Agents of the World" and with over 100 years of combined experience in real estate, all agents of the company are affiliated with AMPI. Wayne Franklin or any member of his knowledgeable team can be contacted in-person at their Romantic Zone Office - Pulpito 145-A at Olas Altas or in their San Marino Office - San Marino Hotel at Rodolfo Gomez 111-4. While in PV they can be reached at (322) 222-6505 or by calling 866-978-5539 (Toll-Free) from the U.S.Click HERE to learn more about Tropicasa Realty, or visit tropicasa.com.